The Power of ITINs

Read time: 3 minutes

Editor’s note: The community member’s name below has been changed at her request to protect her privacy. The story and quotes are that of a real community member.

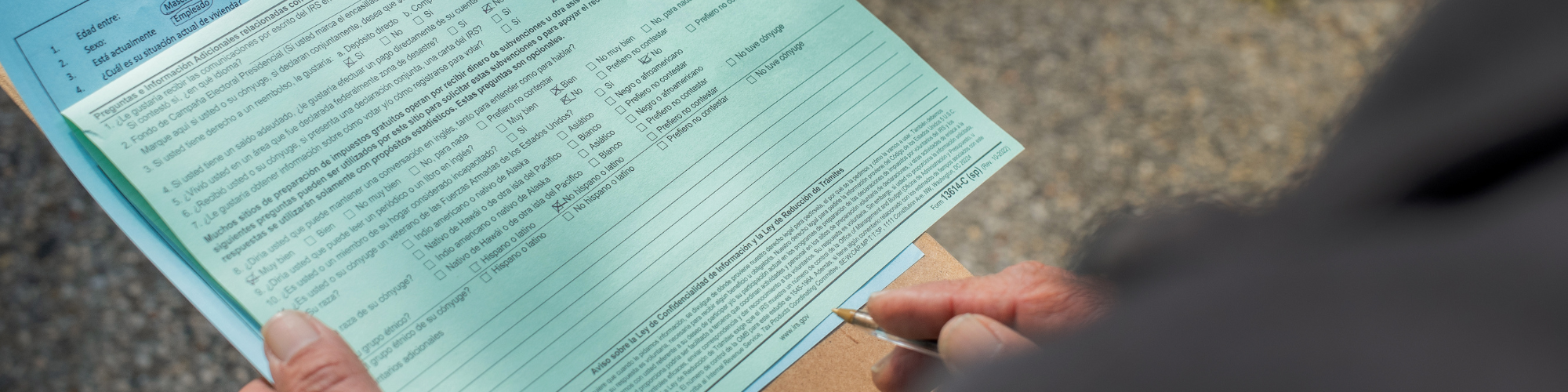

An Individual Tax Identification Number (ITIN) is a tax processing number available to individuals who do not have, and are not eligible to get, a Social Security number (SSN). The Internal Revenue Service (IRS) issues ITINs, and ITINs are issued regardless of immigration status.

Applying for an ITIN is an opportunity to reach financial goals. It allows holders to open a bank account and become eligible for tax credits like the California Earned Income Tax Credit.

Elena, a Los Angeles County resident, started that journey when she moved to California in 1988.

“When I arrived in the U.S., I knew very little English,” Elena shared. “When I was taking classes through adult school, they taught me about paying taxes and the importance of that, but it was my neighbor who told me about the ITIN number and how I could use that to pay my taxes. I know it wasn’t a change in legal status, but it was a way to prove I was here in the U.S. and working.”

Elena applied for ITIN numbers for both herself and her family members and had the process completed in a few months.

“The ITIN has allowed me to receive a tax refund. That refund was always spent on my family. It was used to buy school supplies, clothes, or things for my kids. Having an ITIN also made it possible for me to open a bank account, which is very helpful.”

United Ways of California is proud that many of the Volunteer Income Tax Assistance (VITA) sites in our statewide network have Certified Acceptance Agents on staff. This means that community members can both file their taxes and apply for or renew their ITIN for free at these in-person VITA sites. It also means that ITIN applicants can have their documents verified on-site so that they don’t have to mail original documents in with their application; they won’t have to worry about original copies of important documents getting lost in the mail or being out of their hands for months.

Through our network’s tax credit education and outreach work, California United Ways and our partners also serve as trusted messengers to let potential ITIN filers know about these options.

For more information about the ITIN application process, community members can check out our ITIN Guide or visit a Certified Acceptance Agent at one of our VITA sites.

Frequently Asked ITIN Questions

Can ICE use ITIN information to deport community members?

Current law restricts the IRS from sharing taxpayer information with departments like the Department of Homeland Security.

Can tax credits received count as a public charge?

No, tax credits are not considered a public charge. Tax credits are based on income earned, so the money belongs to the community member.

Does it cost money to apply for an ITIN?

There are a couple of ways to apply for an ITIN. Not all of the options are free, but free options exist. We recommend that community members do both their taxes and their ITIN application with an in-person VITA site, both of which are free.