Manage Your Money Week, October 18-25, 2014

On October 18, the California State Controller’s Office will launch its first annual “Manage Your Money Week.” The event has several goals including: 1) promoting the importance of helping all Californians make good financial decisions; 2) connecting consumers to financial management resources in their own local communities and; 3) providing a framework for state, regional, and local financial education groups to collaborate on highlighting their respective programs and services.

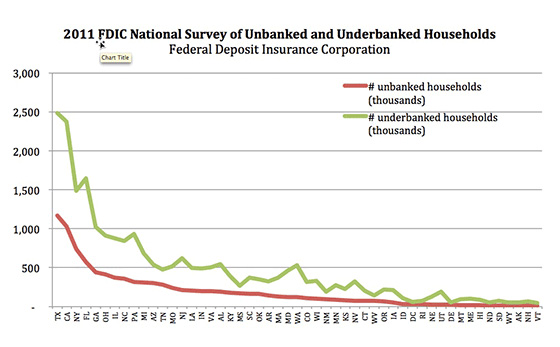

“Manage Your Money Week” is particularly relevant to California. Two years ago, the Federal Deposit Insurance Corporation (FDIC) released results from their 2011 National Survey of Unbanked and Underbanked Households. In it, they found approximately 26% of California households are either unbanked or underbanked, which means that over 2 million households throughout the state lack access to financial institutions that are designed to help protect their financial security. (Only Texas had a higher proportion of unbanked and underbanked households among states). A significant portion of these households are immigrant families who fear that signing up for a checking and savings account may compromise their immigration status and rural households who find it difficult to find a financial institution due to lack of proximity and inefficient public transportation.

To be sure, millions of other Californians throughout the state can benefit from financial education. A survey conducted earlier this year by The National Foundation for Credit Counseling found that 61% of U.S. adults admit to not having a budget and 41% would give themselves a C, D, or F in their knowledge of personal finance.

While barriers to financial literacy and banking institutions certainly exist, there are some positive efforts in California to help address these gaps. Bank On California is a voluntary state program designed to connect households to a slew of financial services ranging from low-cost checking and savings accounts and free education services. United Ways of California is a strong supporter of Bank On as it is consistent with one of our community impact goals of helping low-income families avoid financial crises caused by emergencies and unexpected changes in income. (The California State Legislature is expected to reintroduce SB 385 in the forthcoming legislative session, which seeks to house Bank On California in the Department of Business Oversight. Doing so would provide support and coordination to regional Bank On programs and require participating organizations to provide low or no-cost checking accounts).

Moreover, United Ways throughout California, led by United Way of the Bay Area, has launched Sparkpoint Centers to help individuals and families who are struggling to make ends meet. These services include but are not limited to, one-on-one coaching, credit management, building savings and assets, and job resources. Nineteen United Ways in California also support hundreds of Volunteer Income Tax Assistance (VITA) sites throughout the state. In Santa Clara alone, 7,513 taxpayers were helped in 2014 resulting in over $8.8 million in total refunds. Of that, over $4.2 million were earned income and child tax credits, bringing precious hard-earned funds back to the community. All of these services are provided free of charge for anyone seeking assistance.

In “Manage Your Money Week,” we see great opportunities to help bring awareness to the financial challenges Californians face every day. To learn more about “Manage Your Money Week,” including partnership and collaboration opportunities, please visit the State Controller’s website.