Governor’s May Revise Showcases Stark Economic Reality Amid The Covid-19 Pandemic

In January, California was propelling the American economic resurgence—with 118 consecutive months of growth, stratospheric job creation, and its highest credit rating in nearly two decades. Because of prudent one-time investments which enabled the state to attain the largest rainy day fund in its history, California in a far stronger fiscal position today than it has been during previous downturns.

In this blog post, we will go over:

- California’s economic outlook prior to the COVID-19 induced recession.

- The rationale for this year’s May Revise and projected budget cuts.

- An in depth analysis of areas most important to our members, including: education & child care, financial stability, health, as well as housing & homelessness; and,

- The State’s Economic Outlook for the Future.

California’s January Budget Proposal

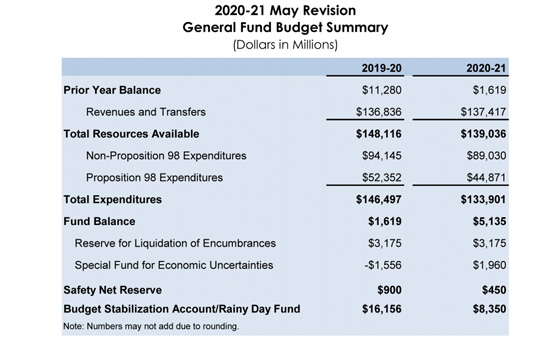

California began 2020 with a solid fiscal foundation—a strong and diverse economy, historic reserves, and a structurally balanced budget. It had eliminated past budgetary debts and deferrals and was making extraordinary payments to reduce pension liabilities. In January, a budget surplus of $5.6 billion was projected for the 2020-21 fiscal year. Revenues through March were running $1.35 billion above projections.

COVID-19 Impact

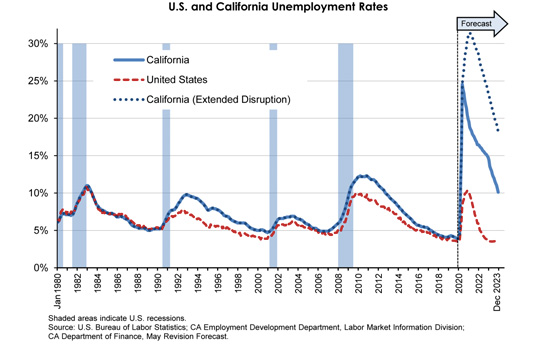

Unemployment claims have surged—with increased claims of 4.4 million from mid-March to May 9, and a projected 2020 unemployment rate of 18 percent. Job losses have occurred in nearly every sector of the economy, but they have been most acute in sectors not fully able to telework such as leisure and hospitality, retail trade, and personal services. Lower-wage workers have disproportionately borne the impact of job losses. COVID-19 has amplified the wage disparity that existed before the pandemic—a fact that is particularly concerning as state median income did not return to the pre-Great Recession level until 2018. Personal income is projected to decline by 9 percent in 2020; in 2023, personal income is expected to return to the 2019 level of $2.6 trillion—$470 billion or 15 percent below the level expected in the Governor’s Budget.

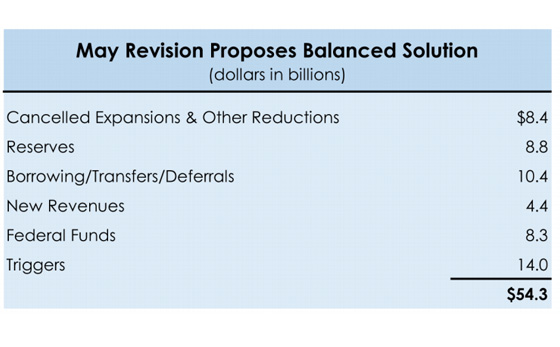

Job losses and business closures are sharply reducing state revenues. Compared to the January forecast, General Fund revenues are projected to decline over $41 billion. This revenue drop, combined with increased costs in health and human services programs and the added costs to address COVID-19, leads to a projected budget deficit of approximately $54 billion before the changes proposed in the May Revision. Without the actions below, the out-year structural deficit would be approximately $45 billion annually.

Balancing the Budget Gap: The state is constitutionally required to enact a balanced budget. Consistent with this obligation, the May Revision proposes to:

- Cancel $6.1 billion in program expansions and spending increases, including canceling or reducing a number of one-time expenditures included in the 2019 Budget Act.

- It also includes redirecting $2.4 billion in extraordinary payments to California Public Employees’ Retirement System (CalPERS) to temporarily offset the state’s obligations to CalPERS in 2020-21 and 2021-22.

- It further reflects savings from the Administration’s direction to agencies to increase efficiency in state operations now and into the future.

- Draw down $16.2 billion in the Budget Stabilization Account (Rainy Day Fund) over three years, and allocate the Safety Net Reserve to offset increased costs in health and human services programs over the next two years. The May Revision reflects the withdrawal of $8.3 billion, including $7.8 billion from the Rainy Day Fund and $450 million from the Safety Net Reserve in 2020-21.

- Borrow and transfer $4.1 billion from special funds.

- Temporarily suspend net operating losses and temporarily limit to $5 million the amount of credits a taxpayer can use in any given tax year. These short-term limitations will generate new revenue of $4.4 billion in 2020-21, $3.3 billion in 2021-22, and $1.5 billion in 2022-23 to increase funding for schools and community colleges and maintain other core services.

- Reflect the Administration’s nationwide request of $1 trillion in flexible federal funds to support all 50 states and local governments, and identifies reductions to base programs and employee compensation that will be necessary if sufficient federal funding does not materialize.

Protecting the Public Health, Public Safety, and Public Education: The May Revision protects public health and public safety. It provides needed funds to contain the spread of COVID-19 and its effects. To that end, the May Revision proposes to:

Invest in wildfire prevention and mitigation as well as other emergency response capabilities.

Prioritize $4.4 billion in federal funding to address learning loss and equity issues exacerbated by the COVID-19 school closures this spring. These funds will be used by districts to run summer programs and other programs that address equity gaps that were widened during the school closures. These funds will also be used to make necessary modifications so that schools can reopen in the fall and help support parents’ ability to work.

Reallocate $2.3 billion in funds previously dedicated to paying down schools’ long-term unfunded liability to California State Teachers’ Retirement System (CalSTRS) and CalPERS to instead pay the school employers’ retirement contributions, to address the decline in the constitutionally required funding for schools and community colleges resulting from the COVID-19 Recession.

Create a new obligation of 1.5 percent of state appropriation limit revenues starting in 2021-22 to avoid a permanent decline in school funding that grows to $4.6 billion in additional funding for schools and community colleges in 2023-24.

Preserve the number of state-funded childcare slots and expand access to childcare for first responders.

Preserve community college free-tuition waivers and maintain Cal Grants for college students, including the grants for students with dependent children established last year. Since many workers return to higher education and job training after losing a job, continuing these programs and initiatives will prioritize affordability and access to higher education and job training opportunities.

K-12 Education

California provides instruction and support services to roughly six million students in grades kindergarten through twelve in more than 10,000 schools throughout the state. A system of 58 county offices of education, 1,000 local school districts, and more than 1,200 charter schools provides instruction in English, mathematics, history, science, and other core competencies. The May Revision includes total funding of $99.7 billion ($47.7 billion General Fund and $52 billion other funds) for all K-12 education programs.

Proposition 98: Proposition 98 is a voter-approved constitutional amendment that guarantees minimum funding levels for K-12 schools and community colleges. The Guarantee, which went into effect in the 1988-89 fiscal year, determines funding levels according to multiple factors including the level of funding in 1986-87, General Fund revenues, per capita personal income, and school attendance growth or decline. The Local Control Funding Formula is the primary mechanism for distributing these funds to support all students attending K-12 public schools in California. The COVID-19 Recession is having a massive impact on the economy and the state’s General Fund revenues. This is having an equally significant negative impact on the state’s K-14 Proposition 98 Guarantee. The May Revision estimates that the Guarantee will decline by $19 billion from the Governor’s Budget. This decline in funding is approximately 23 percent of the 2019 Budget Act Proposition 98 funding level. Even more troubling, is that declining average daily attendance and declining per capita income numbers cause the Guarantee to stay at a depressed level for the entire forecast period. To mitigate the deleterious impacts of the state’s revenue decline impacts on funding for K-14 schools immediately, the May Revision proposes the following:

- Temporary Revenue Increases. The May Revision proposes the temporary three-year suspension of net operating losses and limitation on business incentive tax credits to offset no more than $5 million of tax liability per year. These measures along with other more minor tax changes will generate $4.5 billion in General Fund revenues and approximately $1.8 billion in benefit to the Proposition 98 Guarantee.

- Federal Funds. The May Revision proposes a one-time investment of $4.4 billion ($4 billion federal Coronavirus Relief Fund and $355 million federal Governor’s Emergency Education Relief Fund) to local educational agencies to address learning loss related to COVID-19 school closures, especially for students most heavily impacted by those closures, including supporting an earlier start date for the next school year.

- Revising CalPERS/CalSTRS Contributions. The 2019 Budget Act included $850 million to buy down local educational agency employer contribution rates for CalSTRS and CalPERS in 2019-20 and 2020-21, as well as $2.3 billion towards the employer long-term unfunded liability. To provide local educational agencies with increased fiscal relief, the May Revision proposes redirecting the $2.3 billion paid to CalSTRS and CalPERS towards long-term unfunded liabilities to further reduce employer contribution rates in 2020-21 and 2021-22. This reallocation will reduce the CalSTRS employer rate from 18.41 percent to approximately 16.15 percent in 2020-21 and from 18.2 percent to 16.02 percent in 2021-22. The CalPERS Schools Pool employer contribution rate will be reduced from 22.67 percent to 20.7 percent in 2020-21 and from 25 percent to 22.84 percent in 2021-22.

The May Revision also proposes a significant new obligation for schools to avoid a permanently depressed level of funding for K-14 schools. In 2019-20 and 2020-21, the Proposition 98 funding level drops below the target funding level (Test 2), by a total of approximately $13 billion. To accelerate the recovery from this funding reduction, the May Revision proposes to provide supplemental appropriations above the constitutionally required Proposition 98 funding level, beginning in 2021-22, and in each of the next several fiscal years, in an amount equal to 1.5 percent of General Fund revenues per year, up to a cumulative total of $13 billion. This will accelerate growth in the Guarantee, which the Administration proposes to increase as a share of the General Fund. Currently, Proposition 98 guarantees that K-14 schools receive approximately 38 percent of the General Fund in Test 1 years. The May Revision proposes to increase this share of funding to 40 percent by 2023-24. The May Revision also reflects the withdrawal of all of the funding in the Public School System Stabilization Account, which was projected at the Governor’s Budget to be approximately $524 in 2019-20. The May Revision projects that no additional deposits will be required and the entire amount is available to offset the decline in the Guarantee.

Impacts of COVID-19 on Education: Since the beginning of the COVID-19 pandemic in early March, local educational agencies across the state have closed for classroom instruction, transitioning students and teachers to distance learning models. The loss of classroom-based instruction has had unprecedented impacts on students and families, with significant learning loss for low-income students and students with disabilities. To provide local educational agencies with flexibility to meet the challenges of serving students in this new environment, the Administration and the Legislature have authorized resources and waivers over the last two months designed to support distance learning. These actions include:

- Passing SB 117, which provided $100 million to local educational agencies for cleaning and protective equipment, held local educational agencies harmless for Average Daily Attendance (ADA) loss, waived instructional time requirements to prevent funding loss, made it easier for charter schools to convert to a distance learning model, protected funding for after school programs, and extended timelines for assessments, uniform complaint procedures, and special education requirements.

- Issuing Executive Orders N-26-20, N-30-20, N-45-20, and N-56-20. These orders defined expectations for local educational agencies for service delivery during COVID-19 school closures, suspended state academic assessments for the 2019-20 school year, provided additional time for local educational agencies and communities to complete their local control and accountability plans, increased programmatic flexibility for after school programs, and required local educational agencies to be transparent with their communities about actions taken to ensure continuity of student learning during the COVID-19 pandemic.

The Administration will engage with stakeholders and the Legislature through the spring and summer to determine an appropriate process for the development and adoption of local control and accountability plans and budget overviews for parents that are due December 15, 2020, pursuant to Executive Order N-56-20. The Administration’s priorities for education will include a strong focus on equity for vulnerable students, stability for core instructional programs, learning loss mitigation, and support for helping schools through the current economic downturn. The following May Revision proposals reflect these priorities and provide a roadmap for academic and fiscal recovery.

Learning Loss Mitigation: The May Revision proposes a one-time investment of $4.4 billion ($4 billion federal Coronavirus Relief Fund and $355 million federal Governor’s Emergency Education Relief Fund) to local educational agencies to address learning loss related to COVID-19 school closures, especially for students most heavily impacted by those closures. Specifically, funds may be used for:

- Learning supports that begin prior to the start of the school year, and the continuing intensive instruction and supports into the school year. • Extending the instructional school year, including an earlier start date, by increasing the number of instructional minutes or days.

- Providing additional academic services for pupils, including diagnostic assessments of student learning needs, intensive instruction for addressing gaps in core academic skills, additional instructional materials or supports, or devices and connectivity for the provision of in-classroom and distance learning.

- Providing integrated student supports to address other barriers to learning, such as the provision of health, counseling or mental health services; professional development opportunities to help teachers and parents support pupils in distance-learning contexts; access to school breakfast and lunch programs; or programs to address student trauma and social-emotional learning.

Funds will be allocated to local educational agencies offering classroom-based instruction based on a formula that takes into account the share of students most heavily impacted by school closures, including students with disabilities, low-income students, English learners, youth in foster care, and homeless youth. Additionally, California received $1.6 billion in federal Elementary and Secondary School Emergency Relief funds. Of this amount, 90 percent ($1.5 billion) will be allocated to local educational agencies in proportion to the amount of Title I-A funding they receive for COVID-19 related costs. The remaining 10 percent ($164.7 million) is available for COVID-19 related state-level activities. The May Revision proposes to allocate these funds in the following manner:

- $100 million for grants to county offices of education for the purpose of developing networks of community schools and coordinating health, mental health, and social service supports for high-needs students. The COVID-19 pandemic has exacerbated conditions associated with poverty, including food insecurity, housing and employment instability, and inadequate health care, which has led to additional barriers to learning.

- $63.2 million for training and professional development for teachers, administrators, and other school personnel, focused on mitigating opportunity gaps and providing enhanced equity in learning opportunities, addressing trauma‑related health and mental health barriers to learning, and developing strategies to support necessary changes in the educational program, such as implementing distance learning and social distancing.

- $1.5 million for the Department of Education for state operations costs associated with COVID-19 pandemic.

Aligning K-12 Appropriations With Available Resources: The reduction in the Proposition 98 minimum guarantee, when combined with statutory technical adjustments, creates a shortfall of $15.1 billion ($14.8 billion General Fund) for K-12 schools over 2018-19, 2019-20, and 2020-21. Addressing this gap requires a balance of solutions, including the withdrawal of new proposals, deferrals, and absent additional federal funds, base reductions. The state is not in a fiscal position to increase rates or expand programs given the drastic budget impacts of the COVID-19 Recession. The following proposals are withdrawn from the Governor’s Budget:

- Educator Workforce Investment Grants: $350 million

- Opportunity Grants: $300.3 million

- Community Schools Grants: $300 million

- Special Education Preschool Grant: $250 million

- Workforce Development Grants: $193 million

- Teacher Residency Program: $175 million

- Credential Award Program: $100 million

- Child Nutrition Programs: $70 million

- Classified Teacher Credential Program: $64.1 million

- Local Services Coordination (CCEE): $18 million

- Computer Science Supplementary Authorization Incentive: $15 million

- Online Resource Subscriptions for Schools: $2.5 million

- California College Guidance Initiative: $2.5 million

- Computer Science Resource Lead: $2.5 million

- School Climate Workgroup: $150,000

Additionally, the May Revision suspends the statutory cost-of-living adjustment of 2.31 percent in 2020-21 for all eligible programs.

Local Control Funding Formula: Absent additional federal funds, the COVID-19 Recession requires a 10 percent ($6.5 billion) reduction to LCFF. This reduction includes the elimination of a 2.31 percent cost-of-living adjustment. This reduction will be triggered off if the federal government provides sufficient funding to backfill this cut.The May Revision also proposes apportionment deferrals to align Proposition 98 expenditures and resources with the need of local educational agencies to maintain a level of fiscal stability. In 2019-20, the Budget proposes to defer $1.9 billion of LCFF apportionments to 2020-21. An additional $3.4 billion is added to the 2019-20 deferral in 2020-21, for a total of $5.3 billion in LCFF deferrals scheduled for payment in 2021-22.

Special Education: The May Revision maintains the Administration’s commitment to increasing special education resources and improving special education financing, programs, and student outcomes. Specifically, the May Revision sustains the Governor’s Budget proposal to increase special education base rates, updated at May Revision to $645 per pupil (reflecting the suspension of the 2.31 percent cost-of-living adjustment), apportioned on a three-year rolling average of local educational agency ADA (allocated to Special Education Local Plan Areas). This new base rate represents a 15 percent increase in the Proposition 98 General Fund contribution to the base formula funding over the amount provided in the 2019 Budget Act.

As in the Governor’s Budget, the May Revision proposes that all other existing AB 602 special education categorical funding sources remain as in current law until a finalized formula is adopted.

Further, the May Revision includes $15 million federal Individuals with Disabilities Education Act (IDEA) funds for the Golden State Teacher Scholarship Program to increase the special education teacher pipeline, and $7 million federal IDEA funds to assist local educational agencies with developing regional alternative dispute resolution services and statewide mediation services for cases arising from the COVID-19 pandemic special education distance learning service delivery models.

Finally, the May Revision maintains funding for a study of the current special education governance and accountability structure, and two workgroups to study improved accountability for special education service delivery and student outcomes. The $1.1 million Proposition 98 General Fund used to fund these proposals is replaced with federal IDEA funds. An additional $600,000 federal IDEA funds is proposed for: (1) a workgroup to study the costs of out-of-home care, and how these services can be funded in a way that better aligns with the existing provision of these services, and (2) the development of an individualized education program addendum for distance learning.

K-12 Categorical Programs: Absent additional federal funds, to limit base reductions to the LCFF, the May Revision includes the following Proposition 98 reductions to K-12 categorical programs, totaling $352.9 million:

- After School Education and Safety: $100 million

- K-12 Strong Workforce Program: $79.4 million

- Career Technical Education Incentive Grant Program: $77.4 million

- Adult Education Block Grant: $66.7 million

- California Partnership Academies: $9.4 million

- Career Technical Education Initiative: $7.7 million

- Exploratorium: $3.5 million

- Online Resource Subscriptions for Schools: $3 million

- Specialized Secondary Program: $2.4 million

- Agricultural Career Technical Education Incentive Grant: $2.1 million

- Clean Technology Partnership: $1.3 million

Other K-12 Budget Issues:

Significant Adjustments:

- Local Property Tax Adjustments—An increase of $84.5 million Proposition 98 General Fund in 2019-20 and $727 million Proposition 98 General Fund in 2020-21 for school districts, special education local plan areas, and county offices of education as a result of lower offsetting property tax revenues in both years.

- Full-Day Kindergarten Facilities—A decrease of $300 million one-time non-Proposition 98 General Fund for construction of new, or retrofit of existing, facilities for full-day kindergarten programs. This is roughly the amount that is unexpended from $400 million provided for this purpose in the 2018 and 2019 Budget Acts. The May Revision proposes sweeping these unexpended program funds to facilitate budgetary resiliency.

- AB 1840 Adjustments—An increase of $5.8 million one-time Proposition 98 General Fund for Inglewood Unified School District and $16 million one-time Proposition 98 General Fund for Oakland Unified School District, amounting to 50 percent of the operating deficit of these districts, pursuant to Chapter 426, Statutes of 2018 (AB 1840).

- Categorical Program Growth—A decrease of $10.9 million Proposition 98 General Fund for selected categorical programs, based on updated estimates of average daily attendance.

Flexibilities for Local Educational Agencies: The COVID-19 Recession is going to create tremendous challenges at the local level. The Administration is committed to working with local educational agencies, labor organizations and other stakeholders during this difficult time to offer flexibilities that will minimize impacts to students and allow local educational agencies to continue to make progress on closing the achievement gap for students with disabilities, low-income students, English learners, youth in foster care, and homeless youth. The May Revision includes the following fiscal and programmatic flexibilities:

- Exemptions for local educational agencies if apportionment deferrals create a documented hardship.

- Authority for local educational agencies to exclude state pension payments on behalf of local educational agencies from the calculation of required contributions to routine restricted maintenance.

- Subject to public hearing, increases on local educational agency internal inter-fund borrowing limits to help mitigate the impacts of apportionment deferrals.

- Authority to use proceeds from the sale of surplus property for one-time general fund purposes.

- Options for specified special education staff to utilize technology-based options to serve students.

- Extension of the deadline for transitional kindergarten teachers to obtain 24 college units of early childhood education, from August 1, 2020 to August 1, 2021.

Early Childhood Education & Child Care

To address the impacts of the COVID-19 pandemic on child care providers, the state took immediate action to protect providers and families and expand access to care for vulnerable, at-risk children and children of essential workers. Specifically, the Administration and the Legislature authorized SB 117 and Executive Orders N-45-20 and N-47-20 that accomplish the following:

- Provide 30 days of payment protection to providers who experienced closures or reduced attendance due to the COVID-19 pandemic. • Suspend family fees for 60 days.

- Allow children of essential workers and additional populations of vulnerable children to be eligible for subsidized care, regardless of income.

- Direct the Department of Social Services and the Department of Education to publish guidance on health and safety practices to keep families accessing child care safe during the COVID-19 pandemic.

The Administration also provided $100 million General Fund, pursuant to SB 89, to clean and sanitize child care facilities, provide protective supplies for child care workers, and increase access to subsidized child care for at-risk children and children of essential workers.

To assist with the child care needs of families outside of the subsidized system, the Department of Social Services worked with employers of essential workers to set up pop-up child care programs. To date, there are close to 500 temporary pop-up child care programs throughout California. The state also released a web portal to help parents locate open child care providers near their home or work.

CARES Act Funding for Child Care: California received $350.3 million through the federal CARES Act for COVID-19 related child care activities. To maximize the benefits of these funds to providers and families, the May Revision proposes the following expenditure plan:

- $144.3 million for state costs associated with SB 89 expenditures, family fee waivers, and provider payment protection.

- $125 million for one-time stipends for state-subsidized child care providers offering care during the COVID-19 pandemic.

- $73 million for increased access to care for at-risk children and children of essential workers.

- $8 million to extend family fee waivers until June 30, 2020.

Department of Early Childhood Development: The Governor’s Budget proposed to establish the Department of Early Childhood Development under the California Health and Human Services Agency effective July 1, 2021, to promote a high-quality, affordable, and unified early childhood system. The Governor’s Budget included $6.8 million General Fund in 2020-21 and $10.4 million ongoing General Fund to transition the existing early learning and child care programs from the Department of Education and the Department of Social Services to the new department.

To achieve General Fund savings while maintaining the goal of consolidating the state’s early learning and child care programs under one agency, the May Revision proposes to modify this proposal by transferring the child care programs to the Department of Social Services. This will align all child care programs within a single department in state government and will ease the administration of collective bargaining commencing later this year. The May Revision maintains $2 million General Fund in 2020-21 to support this transition.

State Preschool: The May Revision protects access to the State Preschool program for income-eligible children. While the current fiscal situation requires a pause in the state’s planned early education investments, the Administration’s priority to work toward universal preschool access for all children in unchanged.

Absent additional federal funds, the COVID-19 Recession makes the following reductions necessary to balance the state budget. These reductions will be triggered off if the federal government provides sufficient funding to restore them:

- $159.4 million General Fund to eliminate 10,000 slots scheduled to begin April 1, 2020 and 10,000 additional slots scheduled to begin April 1, 2021.

- $130 million Proposition 98 General Fund to align State Preschool funding with demand.

- $94.6 million Proposition 98 General Fund and $67.3 million General Fund to reflect a 10 percent decrease in the State Preschool daily reimbursement rate.

- $20.5 million Proposition 98 General Fund and $11.6 million General Fund to reflect suspension of a 2.31 percent cost-of-living adjustment.

- $3.3 million Proposition 98 General Fund and $3 million General Fund to eliminate a 1 percent add-on to the full-day State Preschool reimbursement rate.

Child Care: When considering the availability of state General Fund and federal resources at May Revision, the Administration prioritizes access to subsidized child care for income-eligible families. State subsidized child care is critical to keeping low-income women in the workforce, which is more important than ever given the COVID-19 Recession. California received an increase of $53.3 million federal Child Care and Development Block Grant funds for federal fiscal year 2020, which the May Revision proposes to increase access for approximately 5,600 children in the Alternative Payment Program. Absent additional federal funds, the COVID-19 Recession makes the following reductions necessary to balance the state budget. These reductions will be triggered off if the federal government provides sufficient funding to restore them:

- $363 million one-time General Fund and $45 million one-time federal Child Care and Development Block Grant funds from the 2019 Budget Act for child care workforce and infrastructure.

- $223.8 million General Fund to reflect a 10 percent decrease in the Standard Reimbursement Rate and the Regional Market Rate.

- $35.9 million General Fund to reflect to reflect lower caseload estimates in CalWORKs Stage 2 and Stage 3 child care.

- $25.3 General Fund to reflect suspension of a 2.31 percent cost-of-living adjustment.

- $10 million one-time General Fund from the 2019 Budget Act for child care data systems

- $4.4 million one-time General Fund to reduce resources available for the Early Childhood Policy Council, leaving $2.2 million available for both 2020-21 and 2021-22.

Higher Education

Higher Education includes the California Community Colleges (CCC), the California State University (CSU), the University of California (UC), the Student Aid Commission, and several other entities. The May Revision includes $18.6 billion General Fund and local property tax for all higher education entities in 2020-21.

Additionally, the May Revision appropriates $13.4 million federal funds through the Health and Human Services Agency to reflect the state’s 2020 Preschool Development Grant award.

Financial Aid Committment: The May Revision reflects the Administration’s commitment to supporting equity and access at the UC, CSU, and CCCs. The May Revision maintains the state’s investment in two years of free community college while also providing students with continued access to major financial aid programs, including the California College Promise fee waiver, Cal Grant awards, the students with dependent children Cal Grant supplement, and the Middle Class Scholarship. Protecting these programs ensures that hundreds of thousands of low and middle income Californians can still attend a CCC, CSU, or UC campus without the burden of paying tuition.

Expanding Access Through Technology & Innovative Practices: The May Revision reflects the state’s need to accommodate more students while resources are constrained. Although the economic response from the COVID-19 pandemic will constrain the state’s financial resources, the number of students seeking to enroll at UC, CSU, and CCC campuses is expected to grow in the coming years. CCCs, in particular, will likely see notable increases because their enrollment tends to rise when economic challenges emerge.

The Administration expects that the UC, CSU, and CCCs will continue to work toward maximizing access and maximizing equity, even in an era of constrained state resources. Each segment is expected to harness its innovative strength in order to:

- Create, expand, and continually improve the quality of online educational opportunities that are broadly accessible.

- Adopt policies that better enable underrepresented students interested in job reskilling to enroll in college courses and programs.

- Collaboratively adopt the use of a common online learning management system, for example, Canvas, which is already used by over 80 percent of the UC, CSU, and CCCs.

- Expand opportunities for competency-based education and for credit-by-exam to enable students to earn credit for a broader range of previous experiences, including on-the-job training, internships, military service, or independent efforts.

- Collaboratively develop a common approach to awarding credit for similar learning outcomes, regardless of which segment or campus was involved.

- Establish system-wide policy goals in the following areas:

The percentage of courses using open educational resources and offered online.

The percentage of students earning credit through competency-based education and/or credit by exam.

Providing registration priority to underrepresented students. - Maintain or further invest in programs that support students’ basic needs particularly for underrepresented students.

Use of Restricted Fund Sources: Numerous statutes authorize the CSU and the CCCs to charge fees to support specific operating and/or enterprise activities, such as campus health services, student parking, student housing, and meal services. The UC’s broad autonomy also enables the UC to charge similar fees. To assist the UC, CSU, and CCCs, the Administration will pursue statutory changes to enable the UC, CSU and CCCs to use restricted fund balances, except lottery balances, to address COVID-19 related impacts and the loss of revenue from university enterprise functions.

Coupled with this, restricted fund balance flexibility would be a requirement for the CSU and the CCCs, and a request of the UC, that any restricted fund balances first be used to mitigate the impacts to programs and services that predominantly support underrepresented student access to, and success at, a college or university, and to expand the number of students annually served in online courses and programs.

Additionally, the Administration will pursue statutory changes authorizing the UC to temporarily use the savings from the refinancing of specified debt to address COVID-19 related impacts and the loss of revenue from university enterprise functions.

Federal CARES Act Funds: The CARES Act included a national total of $30.8 billion to support an Education Stabilization Fund. Of this funding, roughly $14 billion is allocated to a Higher Education Emergency Relief Fund, roughly $13.2 billion is allocated to an Elementary and Secondary School Emergency Relief Fund and $3 billion is allocated to a Governor’s Emergency Education Relief Fund. The UC, CSU, and CCC’s are expected to receive at least $260 million, $525 million, and $579 million, respectively, from the Higher Education Emergency Relief Fund. The federal methodology for allocating these funds to schools and institutions varies, and institutions of higher education are required to expend half of the higher education funds to provide emergency grants to students. The Administration expects CCCs, CSU, and UC to set-aside a portion of the funding for emergency grants to students to provide emergency grant assistance to foster youth.

University of California: Significant Adjustments:

- UC PATH—Increase the authorization for the UC Office of the President to assess campuses to support UC PATH from $15.3 million to $46.8 million and include provisional language requiring the UC Office of the President to collaborate with campuses to maximize their use of non-core funds to support the assessment.

- Graduate Medical Education—An increase of $1.5 million ongoing General Fund to maintain the Proposition 56 Graduate Medical Education Program at an ongoing total of $40 million.

- UC Riverside School of Medicine—Maintain $11.3 million ongoing General Fund to support the current operations of the UC Riverside School of Medicine.

- UC San Francisco School of Medicine Fresno Branch Campus—Maintain $1.2 million ongoing General Fund to support the UC San Francisco School of Medicine Fresno Branch Campus in partnership with UC Merced.

- Subject Matter Project—$6 million federal funds to support subject matter projects to address learning loss in mathematics, science, and English/language arts resulting from the COVID-19 pandemic.

- Animal Shelter Grant Program—Maintain $5 million one-time General Fund for an animal shelter grant demonstration project.

The state is not in a fiscal position to expand programs given the drastic budget impacts of the COVID-19 Recession. The following proposals are withdrawn from the Governor’s Budget:

- $169.2 million ongoing General Fund to support a 5-percent UC base increase.

- $3.6 million ongoing General Fund to support a 5-percent UC Division of Agriculture and Natural Resources base increase.

- $3 million ongoing General Fund to establish the Center for Public Preparedness Multi-Campus Research Initiative.

- $4 million one-time General Fund to support degree and certificate completion programs at UC extension centers.

- $1.3 million one-time General Fund to support a UC Subject Matter Project in computer science.

Absent additional federal funds, the COVID-19 Recession makes the following reductions necessary to balance the state budget. These reductions will be triggered off if the federal government provides sufficient funding to restore them:

- A decrease of $338 million ongoing General Fund to reflect a 10-percent reduction in support of UC. In implementing this reduction, the Administration expects UC to minimize the impact to programs and services serving underrepresented students and student access to the UC.

- A decrease of $34.4 million ongoing General Fund to reflect a 10-percent reduction in support of UC, UC Office of the President, UC PATH, and the UC Division of Agriculture and Natural Resources.

- A decrease of $4 million limited-term General Fund provided to support summer term financial aid.

California State University: The state is not in a fiscal position to expand programs given the drastic budget impacts of the COVID-19 Recession. The following proposals are withdrawn from the Governor’s Budget:

- $199 million ongoing General Fund to support a 5-percent increase in base resources.

- $6 million one-time General Fund to support degree and certificate completion programs.

Absent additional federal funds, the COVID-19 Recession makes the following reductions necessary to balance the state budget. These reductions will be triggered off if the federal government provides sufficient funding to restore them:

- A decrease of $398 million ongoing General Fund to reflect a 10-percent reduction in support for the CSU. In implementing this reduction, the Administration expects the CSU to minimize the impact to programs and services serving underrepresented students and student access to the CSU.

- A decrease of $6 million limited-term General Fund provided to support Summer Term Financial Aid.

California Community Colleges: To assist CCCs in their recovery from the impacts of the COVID-19 pandemic and provide CCCs with additional near term certainty, the May Revision proposes statutory changes to:

- Exempt direct COVID-19 related expenses incurred by districts from the 50 Percent Law. This would not include revenue declines.

- Suspend procedures regarding the development of short-term career technical education courses and programs to expedite the offering of these programs and courses.

- Reflect the revised 2019-20 Student Centered Funding Formula rates.

- Further utilize past-year data sources that have not been impacted by COVID-19 within the Student Centered Funding Formula.

- Extend the Student Centered Funding Formula hold harmless provisions for an additional two years and require reductions to the Student Centered Funding Formula that are necessary to balance the budget to be proportionately applied to all CCCs by reducing the Formula’s rates, stability, and hold harmless provisions.

Significant Adjustments:

- The May Revision sustains support for two years of free community college, for the Student Success Completion Grants, sustains several categorical programs at current funding levels, including the Educational Opportunity Programs and Services Program and the Disabled Students Programs and Services Program, and sustains the proposal to provide $10 million ongoing Proposition 98 General Fund to support immigrant legal services.

- The May Revision maintains $106.4 million Proposition 98 General Fund to support the proposed CCC System Support Program.

Other adjustments:

- An increase of $130.1 million Proposition 98 General Fund as a result of decreased offsetting local property tax revenues.

- A decrease of $11.4 million ongoing Proposition 98 General Fund to establish or support food pantries at community college campuses. The May Revision proposes statutory changes to support community college food pantries within available Student Equity and Achievement Program funding.

- A decrease of $5.8 million ongoing Proposition 98 General Fund to support Dreamer Resource Liaisons. The May Revision proposes statutory changes to support Dreamer Resource Liaisons within available Student Equity and Achievement Program funding.

- Deferral of $330.1 million Proposition 98 General Fund from 2019-20 to 2020‑21.

- Deferral of $662.1 million Proposition 98 General Fund from 2020-21 to 2021‑22.

- CCC Facilities—Including projects proposed at the Governor’s Budget, the May Revision proposes total general obligation bond funding of $223.1 million including $28.4 million to start 25 new capital outlay projects and $194.7 million for the construction phase of 15 projects anticipated to complete design by spring 2020. This allocation represents the next installment of the $2 billion available to CCCs under Proposition 51.

The state is not in a fiscal position to expand programs given the drastic budget impacts of the COVID-19 Recession. The following proposals are withdrawn from the Governor’s Budget:

- $700,000 one-time General Fund provided to the Chancellor’s Office to convene a working group and develop the report required by SB 206. The Administration expects the Chancellor’s Office to seek private philanthropy to support the work group and to develop the required report.

- $15 million one-time Proposition 98 General Fund for a faculty pilot fellowship program.

- $10 million one-time Proposition 98 General Fund for part-time faculty office hours.

- $10 million one-time Proposition 98 General Fund to develop and implement zero-textbook cost degrees.

- $5 million ongoing Proposition 98 General Fund to provide instructional materials for dual enrollment students.

- $9.3 million ongoing Proposition 98 General Fund, of which $0.1 million is attributable a revised cost-of-living adjustment at the May Revision, for a 2.31 percent cost-of-living adjustment for various categorical programs.

Absent additional federal funds, the COVID-19 Recession makes the following reductions necessary to balance the state budget. These reductions will be triggered off if the federal government provides sufficient funding to restore them:

- $167.7 million ongoing Proposition 98 General Fund, of which $0.6 million is attributable a revised cost-of-living adjustment at the May Revision, for a 2.31 percent cost-of-living adjustment for apportionments.

- $31.9 million ongoing Proposition 98 General Fund for enrollment growth.

- $83.2 million Proposition 98 General Fund, of which $40.4 million was one-time, for support of apprenticeship programs, the California Apprenticeship Initiative, and work-based learning models.

- Decreasing available Student Centered Funding Formula Proposition 98 General Fund by $593 million Proposition 98 General Fund, or roughly 10 percent when combined with a foregone cost-of-living adjustment. To maintain student access to CCCs, the Administration proposes statute to proportionally reduce district allocations through adjustments to the Formula’s rates, stability provisions, and hold harmless provisions.

- Decreasing support for the CCC Strong Workforce Program by $135.6 million Proposition 98 General Fund.

- Decreasing support for the Student Equity and Achievement Program by $68.8 million Proposition 98 General Fund.

- Decreasing Support for the Part-Time Faculty Compensation, Part-Time Faculty Office Hours, and the Academic Senate of the CCCs by $7.3 million Proposition 98 General Fund.

- Reducing Support for Calbright College by $3 million Proposition 98 General Fund.

The May Revision also proposes to defer $330 million from 2019-20 to 2020-21 and $662.1 million from 2020-21 to 2021-22. These deferrals will help to maintain programs given the magnitude of the reduction proposed to the schools. Also, the community colleges will benefit from supplemental payments to increase the Proposition 98 guarantee starting in 2021-22.

California Student Aid Commission: The California Student Aid Commission administers financial aid programs, including the Cal Grant program and the Middle Class Scholarship Program. The state’s Cal Grant program is estimated to provide over 394,000 financial aid awards to students who meet specified eligibility criteria in 2019-20.

The Administration remains committed to fostering equity and access within the state’s higher education institutions. In an effort to support college affordability, the May Revision maintains all financial aid programs, adjusted for caseload.

Significant Adjustments

Cal Grant Program Costs—An increase of $599.7 million General Fund in 2020-21 to account for the following:

- Participation Estimates—A decrease of $348,000 in 2020-21 to reflect a decrease in the estimated number of new recipients in 2019-20. The May Revision also reflects increased costs of $11.89 million in 2019-20.

- Temporary Assistance for Needy Families Reimbursements (TANF)—A decrease of $600 million in 2020-21, which increases the amount of General Fund needed for program costs by a like amount. This is a technical adjustment and reflects increased TANF needed in the state’s CalWORKs program.

Tuition Award for Students at Private Nonprofit Institutions—A decrease of $8.9 million General Fund to reflect the reduction of the maximum Cal Grant award for private nonprofit institutions from $9,084 to $8,056. Current law specified the application of this adjustment because required students with associates degree for transfer admittance levels were not met.

The state is not in a fiscal position to expand programs given the drastic budget impacts of the COVID-19 Recession. The following proposals are withdrawn or modified from the Governor’s Budget:

- $1.8 million limited-term to support new leased space for the California Student Aid Commission’s headquarters

- $88.4 million one-time General Fund provided in the 2019 Budget Act to support the Golden State Teacher Grant Program

- $15 million one-time General Fund provided in the 2019 Budget Act to support the Child Savings Accounts Grant Program

- $4.5 million one-time General Fund to revise the proposal for the Student Debt Loan Work group and Outreach to only support the work group, and no longer provide outreach grants to higher education institutions

Scholarship Investment Board: The ScholarShare Investment Board administers the Golden State ScholarShare 529 College Savings Trust Program, the Governor’s Scholarship Programs, and the California Memorial Scholarship Program.

The state is not in a fiscal position to expand programs given the drastic budget impacts of the COVID-19 Recession. The following proposal is withdrawn from the Governor’s Budget:

- A decrease of $15 million one-time General Fund provided in the 2019 Budget Act to support the Child Savings Accounts Grant Program

Fresno Drive: The May Revision maintains $2 million one-time General Fund to support the Fresno Developing the Region’s Inclusive and Vibrant Economy (DRIVE) initiative’s Fresno-Merced Food Innovation Corridor concept. While the Administration recognizes the significance of this project to economic development, the state is not in the fiscal condition to allocate funding levels proposed in the Governor’s Budget and the May Revision proposes reducing the remaining funding allocated for this project as follows:

- $31 million one-time General Fund to support the Fresno-Merced Food Innovation Corridor concept

- $17 million one-time General Fund to support a plan to design educational pathways to improve social and economic mobility in the greater Fresno Region. The Collaborative is expected to receive a grant from the funding allocated in the 2019-20 budget for Innovation Grants.

Financial Stability

During this time of unprecedented unemployment, the Administration will work in partnership with the Legislature to help get people back to work and support the creation of good-paying jobs. It will develop proposals and actions to support a robust and equitable recovery both in the near term and the long term. To this end, the Administration is considering options to support job creation including: assistance to help spur the recovery of small businesses and the jobs they create, support for increased housing affordability and availability and investments in human and physical infrastructure. Any investments and actions will focus on equity, shared prosperity and long-term growth.

Small businesses have suffered massive losses as a result of the COVID-19 Recession. They will face increased costs to modify their operations to reduce the risk of COVID-19 transmission and spread. Given the critical role of small business in California’s economy, the May Revision proposes to:

- Augment the small business guarantee program by $50 million for a total increase of $100 million to fill gaps in available federal assistance. This increase will be leveraged to access existing private lending capacity and philanthropy to provide necessary capital to restart California small businesses.

- Retain Governor’s Budget’s proposals to support new business creation and innovation by waiving the $800 minimum franchise tax for new businesses.

The Governor has convened a Task Force on Business and Jobs Recovery—a diverse group of leaders from business, labor, and the non-profit sector—to develop actionable recommendations and advise the state on how economic recovery can be expedited and address the effects of wage disparity that were made even worse by COVID-19. The Administration is committed to additional actions, informed by the Task Force and other stakeholders, to support a safe, swift and equitable economic recovery. The Administration is also committed to working with colleges and universities to build on their experience with distance learning and develop a statewide educational program that will allow more students to access training and education through distance learning. This will allow non-traditional students who are working and parenting the opportunity to complete coursework at their own pace and after hours.

The COVID-19 Recession is making the effects of wage disparity even worse and is having a disproportionate impact on families living paycheck to paycheck. The May Revision prioritizes direct payments to families, children, seniors and persons with disabilities by doing the following:

- Maintain the newly expanded Earned Income Tax Credit, which puts a billion dollars in the pockets of working families with incomes under $30,000, including a $1,000 credit for eligible families with children under the age of 6.

- Maintain grant levels for families and individuals supported by the CalWORKs and SSI/SSP programs.

- Prioritize funding to maintain current eligibility for critical health care services in both Medi-Cal and the expanded subsidies offered through the Covered California marketplace for Californians with incomes between 400 percent and 600 percent of the federal poverty level.

- In addition, unemployment insurance benefits in 2020-21 are estimated to be $43.8 billion, which is 650 percent higher than the $5.8 billion estimated in the Governor’s Budget. This is primarily supported by federal funding, federal loans, and employer taxes.

Labor & Workforce Development: The Labor and Workforce Development Agency addresses issues relating to California workers and their employers. The Agency is responsible for labor law enforcement, workforce development, and benefit payment and adjudication. The Agency works to combat the underground economy and to help businesses and workers in California.

Since 2019, the Budget has included targeted investments to strengthen the states’ workforce training programs and health care and safety net services. Increases of $35 million in pre-apprenticeship and apprentice training, $36 million in prison to employment training, and over $60 million in Mental Health workforce investments continue to provide the needed resources for the state to meet its ever-changing workforce needs and supplying a pathway for Californians to improve their upward economic mobility.

In light of the unprecedented increase in unemployment due to the COVID-19 Recession, the state must continue to show leadership in addressing workforce health and safety concerns of all Californians as well as support and promote high-quality jobs so workers, families, and communities can secure and maintain economic security. The May Revision continues to move forward with many of the Governor’s Budget proposals to strengthen the state’s workforce and benefit systems as California looks to recover from this recession.

Unemployment Insurace: As a result of the COVID-19 pandemic, the Employment Development Department (EDD) has been inundated with an unprecedented surge in unemployment insurance (UI) claims. As of May 9, EDD has processed and approved approximately 4.4 million UI claims that will provide over $12.2 billion in UI benefits. In an effort to address the nationwide impacts of the COVID-19 pandemic, the federal government enacted the Families First Act and the CARES Act, both providing temporary program enhancements and expanded unemployment insurance benefits to millions of workers who are no longer employed due to the COVID-19 Recession. Most notably, the CARES Act included a federally funded temporary emergency benefit increase of $600 per week through July 31, 2020 and a federally funded Pandemic Unemployment Assistance (PUA) program to provide up to 39 weeks of UI benefits to individuals who do not qualify for traditional unemployment compensation, including business owners, the self-employed, independent contractors, individuals with limited work history, and other individuals not usually eligible for regular state UI benefits who are unemployed as a direct result of the COVID-19 pandemic. The PUA program runs through December 31, 2020.

These federal investments will help stabilize income for the affected workforce in the short term. However, enhanced and expanded benefits are temporary. Additionally, the CARES Act allows states to borrow from the federal government to pay state UI benefits with no interest, but only through the end of 2020. California, like other states, has already begun borrowing and similar to the Great Recession, the state will likely need to borrow in the tens of billions of dollars, resulting in significant future annual interest payments until the loans are repaid. For context, the state borrowed over $65 billion from 2009-2017 and paid total interest of $1.4 billion from 2011-2018.

To address the increased volume of UI claims, EDD has implemented several strategies to increase efficiencies and maintain program continuity. EDD has launched a new call center and expanded hours at existing call centers that will now operate seven days a week from 8:00 a.m. to 8:00 p.m. It has implemented a one-stop shop for those applying for unemployment insurance as well as the new federal PUA program and streamlined the eligibility requirements for claimants allowing for expedited approvals. Additionally, EDD has administratively redirected hundreds of staff internally and added hundreds more from across various state departments to review and process claims.

The May Revision maintains $46 million to continue implementation of the Benefit Systems Modernization Project. This project will modernize and consolidate the department’s Unemployment Insurance (UI), Disability Insurance (DI), and PFL benefit systems. The state of this legacy system and the need to replace it has come into sharp focus during the COVID-19 pandemic as millions of Californians have accessed the system to apply for UI benefits.

Realigning Workforce Training: The COVID-19 Recession is causing unemployment levels the state has never seen. As the economy recovers, it is critical that the state’s workforce training programs are aligned to the jobs that employers need. For these reasons, the Administration is prioritizing the reorganization of various entities under California’s Labor Agency that aligns fragmented programs and services to better support data, policy, and program analysis of the state’s workforce training programs. The proposed consolidation of the state’s workforce training programs under a new Department of Better Jobs and Higher Wages is needed more now than ever given the underlying changes in the state’s economy. The Department will be comprised of the California Workforce Development Board, the Employment Training Panel, Workforce Services Branch, and Labor Market Information Division, which are currently in the Employment Development Department, and the Division of Apprenticeship Standards, currently in the Department of Industrial Relations.

Paid Familiy Leave: The May Revision continues to include the expansion of job protections for any worker eligible for paid family leave (PFL) benefits and resources to support small businesses that extend these benefits to their employees. It also maintains a $10 million General Fund investment for the Social Entrepreneurs for Economic Development initiative, providing entrepreneurial training for individuals, including those who are undocumented.

Health & Human Services

Health Care Services: Medi-Cal, California’s Medicaid program, is administered by the Department of Health Care Services. Medi-Cal is a public health care program that provides comprehensive health care services at no or low cost for low-income individuals. The federal government mandates basic services be included in the program, including: physician services; family nurse practitioner services; hospital inpatient and outpatient services; laboratory and radiology services; family planning; and early and periodic screening, diagnosis, and treatment services for children. In addition to these mandatory services the state provides optional benefits, such as outpatient drugs and medical equipment. The Department also operates the California Children’s Services and the Primary and Rural Health programs, and oversees county-operated community mental health and substance use disorder programs.

The Medi-Cal budget is $99.5 billion ($22.7 billion General Fund) in 2019-20 and $112.1 billion ($23.2 billion General Fund) in 2020-21. The May Revision assumes that caseload will increase significantly due to economic conditions associated with the COVID-19 Recession. Specifically, the May Revision assumes that caseload will peak at 14.5 million in July 2020, or about 2.0 million above what caseload would have been absent the COVID-19 pandemic.

The May Revision maintains Medi-Cal program eligibility, including for the optional expansion and undocumented children and young adults, in order to help the state’s low income residents respond to the COVID-19 pandemic.

The state is not in a fiscal position to increase rates or expand programs given the drastic budget impacts of the COVID-19 Recession. The following proposals are withdrawn from the Governor’s Budget:

- California Advancing and Innovating Medi-Cal (CalAIM)—The May Revision proposes to delay implementation of the CalAIM initiative, resulting in a decrease of $695 million ($347.5 million General Fund) in 2020-21. In addition, the May Revision removes $45.1 million General Fund in 2020-21 and $42 million General Fund in 2021-22 in associated funding for the Behavioral Health Quality Improvement Program.

- Full-Scope Medi-Cal to Undocumented Older Adults—The May Revision proposes to withdraw this proposal for a savings of $112.7 million ($87 million General Fund), inclusive of In-Home Supportive Services costs.

- Medi-Cal Aged, Blind, and Disabled Income Level Expansion—The May Revision proposes not to implement the 2019 Budget Act expansion of Medi-Cal to aged, blind, and disabled individuals with incomes between 123 percent and 138 percent of the federal poverty level, for a savings of $135.5 million ($67.7 million General Fund). Furthermore, the May Revision proposes not to implement the Aged, Blind, and Disabled Medicare Part B disregard.

- 340B Supplemental Payment Pool—The May Revision proposes to withdraw this proposal to provide payments to non-hospital clinics for 340B pharmacy services for a savings of $52.5 million ($26.3 million General Fund) in 2020-21, growing to $105 million ($52.5 million General Fund) in 2021-22 and thereafter.

- Postpartum Mental Health Expansion—The May Revision proposes not to implement the 2019 Budget Act expansion of Medi-Cal to post-partum individuals who are receiving health care coverage and who are diagnosed with a maternal mental health condition, for a savings of $34.3 million General Fund in 2020-21.

- Hearing Aids—The May Revision proposes to withdraw this proposal to assist with the cost of hearing aids and related services for children without health insurance coverage in households with incomesup to 600 percent of the federal poverty level, for a savings of $5 million General Fund.

- 2019 Budget Act Reversions—The May Revision proposes to revert and reduce funding from various augmentations that were included in the 2019 Budget Act. These adjustments include reverting funding for behavioral health counselors in emergency departments, Medi-Cal enrollment navigators, and the Medical Interpreters Pilot Project. In addition, the May Revision proposes to eliminate the augmentation for caregiver resource centers. These changes result in General Fund savings of $25 million in 2019-20 and 2020-21, and $10 million in 2021-22.

Absent additional federal funds, the COVID-19 Recession makes the following reductions necessary to balance the state budget. These reductions will be triggered off if the federal government provides sufficient funding to restore them:

- Adult Dental and Other Optional Benefits—The May Revision proposes to reduce adult dental benefits to the partial restoration levels of 2014. In addition, the May Revision proposes to eliminate audiology, incontinence creams and washes, speech therapy, optician/optical lab, podiatry, acupuncture, optometry, nurse anesthetists services, occupational and physical therapy, pharmacist services, screening, brief intervention and referral to treatments for opioids and other illicit drugs in Medi-Cal, and diabetes prevention program services, for a total General Fund savings of $54.7 million.

- Proposition 56 Adjustments—Beginning in 2020-21, the May Revision proposes to shift $1.2 billion in Proposition 56 funding from providing supplemental payments for physician, dental, family health services, developmental screenings, and non-emergency medical transportation, value-based payments, and loan repayments for physicians and dentists to support growth in the Medi-Cal program compared to 2016 Budget Act. About $67 million in Proposition 56 funding would continue to support rate increases for home health providers, pediatric day health care facilities, pediatric sub-acute facilities, AIDS waiver supplemental payments, already awarded physician and dentist loan repayments, and trauma screenings (and associated trainings).

- Community-Based Adult Services (CBAS) and Multipurpose Senior Services Program (MSSP)—The May Revision proposes to eliminate the CBAS and MSSP programs. The effective date for CBAS would be January 1, 2021 for a General Fund savings of $106.8 million in 2020-21 and $255.8 million in 2021-22 (full implementation). The effective date for MSSP would be no sooner than July 1, 2020. These proposals are discussed in detail under The Department of Aging.

- Federally Qualified Health Centers (FQHC) Payment Adjustments—The May Revision proposes to eliminate special carve outs for FQHCs for a savings of $100 million ($50 million General Fund).

- Estate Recovery—The May Revision proposes to reinstate the estate recovery policy in place before the 2016 Budget Act for a General Fund savings of $16.9 million beginning in 2020-21.

- Martin Luther King, Jr. Hospital—The May Revision proposes to eliminate a supplemental payment for this hospital, which results in $8.2 million General Fund savings in 2020-21 and $12.4 million ongoing. • County Administration—The May Revision proposes to hold funding for county administration at the 2019 Budget Act level, inclusive of $12.7 million General Fund approved in March 2020 through the Control Section 36.00 process, for a savings of $31.4 million ($11 million General Fund).

- Family Mosaic Project—The May Revision proposes to eliminate this state-funded project for an ongoing General Fund savings of $1.1 million beginning in 2020-21.

To reduce costs, the May Revision also proposes efficiencies, as follows:

- Managed Care Efficiencies—The May Revision proposes various changes to the way that managed care capitation rates are determined. These changes include various acuity, efficiency, and cost containment adjustments. These adjustments would be effective for the managed care rate year starting January 1, 2021, and would yield General Fund savings of $91.6 million in 2020-21 and $179 million in 2021-22, growing thereafter. Additionally, the May revision assumes a 1.5 percent rate reduction for the period July 1, 2019, through December 31, 2020, for General Fund savings of $182 million in 2020-21.

The May Revision also contains the following adjustments:

- Enhanced Federal Funding—A decrease of $5.1 billion General Fund, associated with the assumed receipt of an enhanced Federal Medical Assistance Percentage (FMAP) through June 30, 2021. This includes federal funding reflected in the Department of Social Services and Department of Developmental Services budgets for Medicaid-covered services.

- Managed Care Organization (MCO) Tax—A decrease of $1.7 billion General Fund in 2020-21 associated with the April 2020 federal approval of a revised MCO tax.

- Drug Rebate Reserve—A decrease of $181 million General Fund due to not restoring a drug rebate volatility reserve.

- County Medical Services Program (CMSP)—The CMSP Board has amassed a considerable reserve since the state changed their realignment allocation in the wake of implementing the Affordable Care Act. The 2019 Budget Act suspended the Board’s annual allocation until the reserve level reaches two years of expenditures, shifting the revenues the Board otherwise would have received to offset General Fund costs in the CalWORKs program. In light of the COVID-19 pandemic, the May Revision proposes to shift $50 million of the reserves in each of the next four fiscal years to offset General Fund CalWORKs costs. In recognition of the expedited timeline by which the reserves would return to reasonable levels, the May Revision also proposes to restore the Board’s annual allocation beginning in 2021-22.

- Skilled Nursing Facilities (SNFs)—To support COVID-19 response in SNFs, the May Revision maintains the nursing facility reform framework proposed in the Governor’s Budget. In addition, the May Revision assumes a 10-percent rate increase for SNFs for four months during the COVID-19 pandemic, at a General Fund cost of $72.4 million in 2019-20 and $41.6 million in 2020-21. The Administration is waiting approval from the federal Centers for Medicare and Medicaid Services to implement this increase.

- e-cigarette Tax—A decrease of $10 million General Fund in 2020-21, and $33 million General Fund ongoing beginning in 2021-22, associated with shifting unallocated revenues from the proposed e-cigarette tax increase to support growth in Medi-Cal costs.

Social Services: The Department of Social Services (DSS) serves, aids, and protects needy and vulnerable children and adults in ways that strengthen and preserve families, encourage personal responsibility, and foster independence. The Department’s major programs include CalWORKs, CalFresh, In-Home Supportive Services (IHSS), Supplemental Security Income/State Supplementary Payment (SSI/SSP), Child Welfare Services, Community Care Licensing, and Disability Determination. The May Revision includes $32.1 billion ($13 billion General Fund) for DSS programs in 2020-21.

The Department administers a wide array of federal and state-funded services that provide cash assistance; food and nutrition; services to help protect children and assist families; care and assistance programs for adults; services for foster parents, youth and families; adoption services; hearings and appeals; and services for refugees, immigrants, trafficking victims, disaster victims, and housing and homelessness services. The May Revision maintains eligibility for these critical services as the state recovers from the COVID-19 pandemic. The May Revision also maintains critical social services as many families are in need as the state recovers from the COVID-19 Recession.

CalWORKs: The CalWORKs program, California’s version of the federal Temporary Assistance for Needy Families (TANF) program, provides temporary cash assistance to low-income families with children to meet basic needs. Eligibility requirements and benefit levels are established by the state. Counties have flexibility in program design, services, and funding to meet local needs.

Total TANF expenditures are $11.2 billion (state, local, and federal funds) in 2020-21. The amount budgeted includes $9.2 billion for CalWORKs program expenditures and $2 billion in other programs. Other programs include Child Care, Child Welfare Services, Foster Care, Department of Developmental Services programs, the Statewide Automated Welfare System, Work Incentive Nutritional Supplement, California Community Colleges Child Care and Education Services, Cal Grants, and the Department of Child Support Services. Average monthly CalWORKs caseload is estimated to be approximately 724,000 families in 2020-21, a 102 percent increase from the Governor’s Budget projection due to the COVID-19 pandemic.

The May Revision maintains CalWORKs program eligibility, in order to support the state’s low-income residents respond during the COVID-19 pandemic. In addition, the May Revision includes an increase of $82.3 million General Fund/TANF Block Grant for CalWORKs county administration to facilitate enrollment in the program and services to beneficiaries.

The May Revision assumes the Safety Net Reserve is used to support health and social services programs over the course of two years. This proposal would result in a savings of $450 million General Fund in 2020-21 and $450 million in 2021-22.

Absent additional federal funds, the COVID-19 Recession makes the following reductions necessary to balance the state budget. These reductions will be triggered off if the federal government provides sufficient funding to restore them:

- CalWORKs Employment Services and Child Care—The May Revision reflects reduced assumptions about the uses of CalWORKs Employment Services and Child Care. These changes would result in a savings of $665 million General Fund in 2020-21.

- CalWORKs Expanded Subsidized Employment—The May Revision reduces all but the base funding for CalWORKs Subsidized Employment. This proposal would result in a savings of $134.1 million General Fund in 2020-21.

- CalWORKs Home Visiting—The May Revision reduces funding for CalWORKs Home Visiting. This proposal would result in a savings of $30 million General Fund in 2020-21.

- CalWORKs Outcomes and Accountability Review (CalOAR)—The May Revision eliminates funding for CalOAR, but provides counties the options the ability to continue implementing this improvement. This proposal would result in a savings of $21 million General Fund in 2020-21.

In-Home Support Services: The IHSS program provides domestic and related services such as housework and transportation, and personal care services to eligible low-income aged, blind, and disabled persons. These services are provided to assist individuals to remain safely in their homes. The May Revision includes $14.7 billion ($4.3 billion General Fund) for the IHSS program in 2020-21. Average monthly caseload in this program is estimated to be 581,901 recipients in 2020-21, a 0.4-percent decrease from the Governor’s Budget.

To reduce costs, the May Revision also proposes efficiencies, as follows:

- Conform IHSS Residual Program to Timing of Medi-Cal Coverage—The May Revision assumes the IHSS Residual Program conforms to timing of Medi-Cal coverage. This proposal would result in a savings of $72.6 million General Fund in 2020-21.

- IHSS Payroll savings—The May Revision assumes the Department will enter into a contract with the state Case Management, Information, and Payroll System vendor to perform IHSS payroll functions. This proposal would result in a savings of $9.2 million General Fund in 2020-21.

Absent additional federal funds, the COVID-19 Recession makes the following reductions necessary to balance the state budget. These reductions will be triggered off if the federal government provides sufficient funding to restore them:

- HSS Service Hours—The May Revision assumes a 7-percent reduction in the number of hours provided to IHSS beneficiaries, effective January 1, 2021. This proposal would result in a savings of $205 million General Fund in 2020-21.

- County and Public Authority Administration—The May Revision freezes IHSS county administration funding at the 2019-20 level. This proposal would result in a savings of $12.2 million General Fund in 2020-21.

Supplemental Security Income & State Supplementary Payment(SSI/SSP): The federal SSI program provides a monthly cash benefit to eligible aged, blind, and disabled persons who meet the program’s income and resource requirements. In California, the SSI payment is augmented with an SSP grant. These cash grants assist recipients with basic needs and living expenses. The federal Social Security Administration administers the SSI/SSP program, making eligibility determinations, computing grants and issuing combined monthly checks to recipients. The state-only Cash Assistance Program for Immigrants provides monthly cash benefits to aged, blind, and disabled legal noncitizens who are ineligible for SSI/SSP due solely to their immigration status.

The May Revision includes $2.7 billion General Fund in 2020-21 for the SSI/SSP program. This represents a 0.4-percent increase from the Governor’s Budget. The average monthly caseload in this program is estimated to be 1.2 million recipients in 2020-21, a 0.7-percent increase from the Governor’s Budget. The May Revision preserves funding for the expansion of CalFresh eligibility to SSI recipients.

Absent additional federal funds, the COVID-19 Recession makes the following reductions necessary to balance the state budget. This reduction will be triggered off if the federal government provides sufficient funding to restore them:

- SSI/SSP Grants—The May Revision assumes an offset to the SSP grant that is equivalent to the amount of the federal January 2021 cost of living adjustment to the SSI portion of the grant. This proposal would result in a savings of $33.6 million General Fund in 2020-21, but no reduction in overall SSI/SSP grants received by recipients compared to the prior year.

Children’s Program: Child Welfare Services include family support and maltreatment prevention services, child protective services, foster care services, and permanency programs. California’s child welfare system provides a continuum of services for children who are either at risk of, or have suffered, abuse, neglect, or exploitation. Program success is measured in terms of improving the safety, permanence, and well-being of children and families. The May Revision includes $506.1 million General Fund on 2020-21 for these programs, an decrease of $90.5 million General Fund since the Governor’s Budget. When federal, state, 1991 Realignment, and 2011 Realignment funds are included, total funding for children’s programs is over $6.7 billion in 2020-21.

The state is not in a fiscal position to increase rates or expand programs given the drastic budget impacts of the COVID-19 Recession. The following proposals are withdrawn from the Governor’s Budget:

- Foster Family Agencies—The May Revision eliminates Foster Family Agency social worker rate increases. This proposal would result in a savings of $4.8 million General Fund in 2020-21.