Governor Newsom Releases 2021-22 Budget Proposal

Key Investments Brief For UWCA Members

Executive Summary

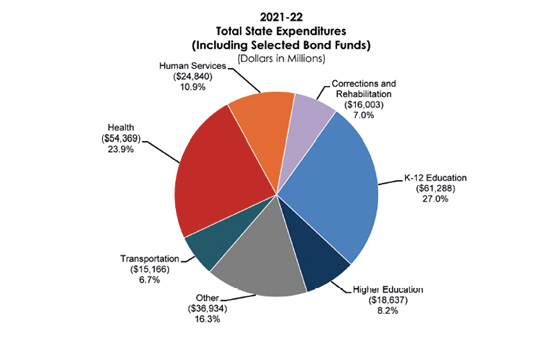

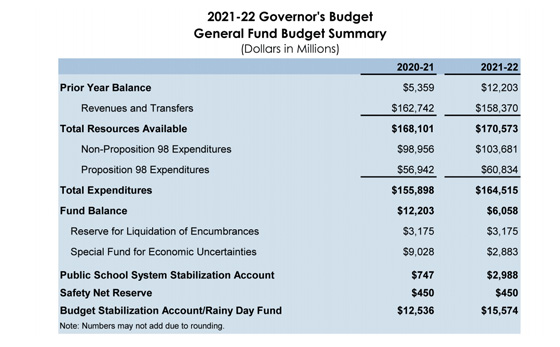

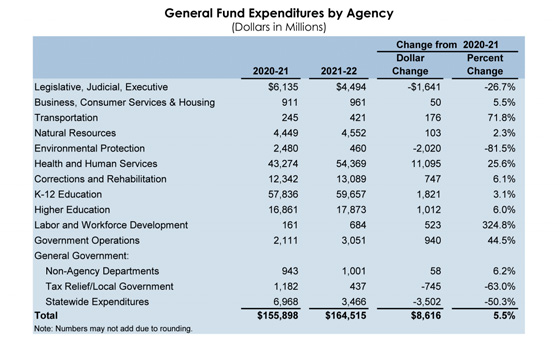

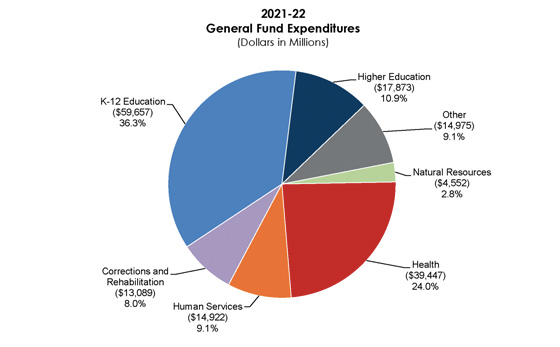

On January 8, 2021, Governor Newsom unveiled his proposed 2021-2022 budget, amounting to a $227 billion spending plan, thanks in large part to an estimated $26 billion windfall in tax revenues according to the Legislative Analyst’s Office estimates from November 2020. The Budget closes a $54.3 billion gap in 2020-21 and significantly reduces the state’s ongoing structural deficit to $8.7 billion in 2021-22, after accounting for reserves.

The Governor’s Budget includes a $14 billion investment – including early action beginning this month – to provide immediate economic relief for individuals and small businesses disproportionately impacted by the pandemic, the safe reopening of schools and for extended learning time, and investment in strategies for creating jobs. The Budget also continues the Governor’s sustained focus on expanding opportunity with investments for Californians from early childhood to college – including expanded transitional kindergarten programs and more funding for the University of California, California State University, and California Community College system.

The Budget makes new proposals to address the affordability of health care and housing, and supports the increase in the state’s minimum wage to $14 per hour. It also includes significant new strategies to reduce the impacts of climate change, with focused investments to support the state’s zero-emission vehicle goals and an additional $1 billion to address a comprehensive wildfire and forest resilience strategy.

The overall fiscal forecast for California is cautiously optimistic for the current budget year. The economic outlook and revenue forecast have improved; however, risks to the forecast remain higher than usual, and economic inequality has intensified since the COVID-19 pandemic. The Governor outlined $34 billion in budget resiliency funds – budgetary reserves and discretionary surplus – that will advance a broad-based and equity-minded recovery. Specifically it would include $15.6 billion for the Rainy day fund, $450 million from the Safety Net Reserve, $3 billion from the Public School System Stabilization Account, and $2.9 billion from the state’s operating reserve.

The proposed budget is just the starting point for the budget process as the Legislature has until June to negotiate and approve the final 2021-22 budget. Governor Newsom must sign it into law by July 1, 2020 per the California constitution. It is in this 5-6 month window that our collective voice needs to be heard by decision-makers to ensure our communities are invested in appropriately at such a challenging time for our state and nation.

Of critical note, in a fairly unprecedented move, the Governor is also including what are being called “mid-year adjustments” to the current fiscal year budget of 2020-2021. This will add revenue to the budget through June 30, 2021, as we understand it based on initial reports. This will include some aspects of the budget proposal discussed below, but will require a wholly separate budget negotiation process with the legislature and a very aggressive timeline for budget hearings, etc so funds will be available to be disbursed as early as February for things like the Golden State Stimulus.

Policy Area Investments

Education

The Budget’s improved revenue estimate results in not only significantly more funding for schools, but also the highest funding level ever at $85.8 billion. This is an increase of $14.9 billion from 2020.

Early Childhood Education: The Budget includes a number of one-time investments, from multiple sources, for a total of approximately $400 million over multiple years. The proposals include the following:

- $250 million in one-time GF to expand transitional kindergarten for all four-year olds.

- $200 million in one-time GF for transitional kindergarten and kindergarten facilities.

- $50 million in one-time GF for professional development focused on preparing teachers for early childhood programs.

- The budget also reflects $44 million ongoing Cannabis Funds for 4,500 more child care vouchers, including $21.5 million in 2020-2021.

- K-14: The Proposition 98 funding for K-14 schools for 2021-2022 is $85.8 billion, with many adjustments to pay back the temporary cuts experienced in the previous fiscal year due to COVID-19 revenue losses. The budget reflects a $3.4 billion in non-proposition 98 GF for K-14 education.(K-14 schools are expected to receive billions of additional federal funds)

- Deferrals: Budget pays off the full K-12 deferral in 2019-20 and $7.3 billion of the K-12 deferral in 2020-21, leaving an ongoing K-12 deferral balance of $3.7 billion in 2021-22. At this new lower level, LEAs will experience only a few weeks delay in receiving apportionment in 2021-22 (as opposed to 10 months of delay in 2020-21), as it will only impact their June 2022 apportionment, which will be delayed into July 2022.

- Supplemental Payment: Instead of a $12.4 billion drop in Prop 98 funding in 2019-20 and 2020-21, the Budget now projects a decline of $511 million and the Guarantee is now at a level that, under previous projections, would have taken years to reach. As a result, the Budget proposes to remove the supplemental payment from statute. However, the Budget includes a one-time supplementary payment to K-14 schools of $2.3 billion in 2021-22.

- Safe Re-opening Plans: $2 billion for the safe reopening of schools beginning in February, with a priority for returning the youngest children (transitional kindergarten through 2nd grade) and those with the greatest need first, then returning other grade levels to in-person instruction through the spring.

- Average Daily Attendance Collection: The Budget assumes that in-person instruction is the default mode of instruction in 2021-22. The Budget does not include a new ADA hold harmless in 2021-22. However, because of the ADA hold harmless in the 2020 Budget, LEAs that experience enrollment declines in 2021-22 will retain the ability to receive apportionment based on the higher of their 2019-20 or 2020-21 ADA, pursuant to the exiint hold harmless provisions included in LCFF statue.

- Local Control Funding Formula: The Budget includes statutory changes to address concerns that some LEAs allocate funds for increased and improved services and then leave them unspent, reallocating them for other purposes in future years. This statutory language requires that, once established, an LEA’s responsibility to increase and improve services continues until fulfilled, and increases that specificity required of county offices of education in their review of LEAs’ LCAPs.

- Proposition 98: Provide $100 million one-time fund to support emergency student financial assistance grants for full-time, low-income community college students and other students. Provide $20 million one-time to support efforts to bolster CCC student retention rates and enrollment.

Student Mental Health: $400 million in one-time funding to implement an incentive plan through Medi-cal managed care plans, in partnership with county behavioral health departments, to increase the number of students receiving preventative and early intervention behavioral health services by schools.

- The Budget also includes $265 million to develop community school models to address children’s needs.

- $50 million in one-time GF to create statewide resources and provide professional development on social emotional learning and trauma-informed practices, and $25 million for the Mental Health Services Fund to fund partnership grants between county behavioral health departments and school districts.

Professional Development: $315 million for educator professional development, with emphasis on developing quality training in high-needs areas and providing timely access to training, specifically:

- $250 million one-time Prop 98 GF for the educator Effectiveness Block Grant to provide LEAs with resources to expedite professional development for teachers, administrators, and other in-person staff, in high-needs areas including accelerating learning, re-engaging students, restorative practices, and implicit bias training.

- $50 million one-time Prop 98 GF to create statewide resources and provide targeted professional development on social-emotional learning and trauma-informed practices.

Teacher Pipeline: $225 million one-time Prop 98 GF to prove the state’s teacher pipeline.

- $100 million for the Golden State Teacher Grant Program.

- $100 million to expand the Teacher Residency Program.

- $25 million to expand classified School Employees Credentialing Program.

FAFSA: The Budget requires LEAs to confirm that all high school seniors complete a FAFSA or CA Dream Act Application beginning in the 2021-22 academic year.

- Special Education: $300 million

- Cradle to Career Data System: Budget provides $15 million GF to establish an office within the Government Operations Agency to provide support and resources.

- School Facilities: Budget allocates $1.5 billion Prop 51 funds to support school construction projects, which is more than double the amount allocated in 2018-19.

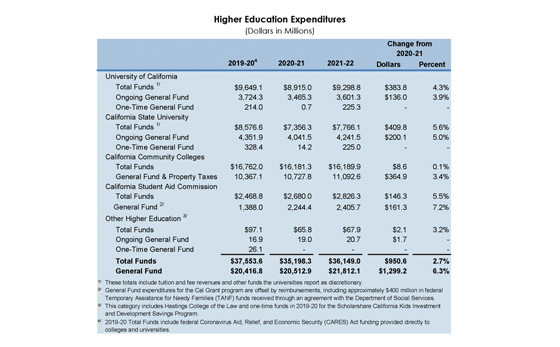

Higher Ed: The Budget proposes total funding of $36.1 billion for higher education. The total reflects a change of $951 million compared to revised 2020-2021 expenditures. Does not include the estimated $2.9 billion included in recent federal COVID-19 relief bill.

UC System: $136 million ongoing to provide a 3% increase in base resources to support base resources.

- $225 M One time additional to address deferred maintenance.

Ongoing Adjustments:

- Base Growth: An increase of $103 million with the expectation that the UC will maintain resident undergraduate tuition and fees at existing levels for the 2021-22 academic year.

- $95 million to provide an increase in base resource available to campuses of three percent.

- $35 million to add 9,000 Cal Grant Competitive grants, bringin the total number of awards to 50,000.

- Foster Youth Access Award: $20 million to increase acces awards for all former or current foster youth.

CSU System: $425 million

- $144 million ongoing to provide a 3% increase in base resources to support operational costs

- $225 million one time GF to support emergency financial assistance grants to students in need, for culturally competent professional development focused on the provision of online corses and programs, support for the Computing Talent Initiative, and for deferred maintenance.

These investments are provided with the expectation that CSU:

- Maintain current tuition fees for the 2021-22 academic year.

- Take action to reduce equity gaps with the goal of fully closing equity gaps by 2025.

- Adopt policies furthering education opportunities using online learning programs.

- Better align student learning objectives with workforce needs.

Graduation Initiative 2025: $15 million ongoing GF to sustain and expand support for the Basic Needs Initiative component.

One-Time Adjustments

- Deferred Maintenance: $175 million to address deferred maintenance at CSU campuses.

- Emergency Student Financial Assistance: $30 million to support emergency financial assistance grants for full time low-income students.

- Faculty Professional Development: $10 million to provide culturally competent professional development.

Community College System: Fall 2020 CCC enrollment was down by 8% from the prior fall term. Preliminary year-over-year FAFSA completion for first-time freshmen application completion is down by nearly 4.5%. To mitigate these concerns:

- $150 million in one-time Prop 98 GF to support emergency student financial assistance grants for full-time, low-income CC students and other students who were previously working full-time, or the equivalent of full-time, who can demonstrate an emergency financial need.

- $20 million to bolster CCC student retention rates and enrollment. Funds will be primarily to engage former students who withdrew due to COVID-19.

- Amend statute to restore Cal Grant A eligibility for students impacted by a change in their living status due to the pandemic at an estimated cost of $58.8 million ongoing GS starting in 2020-21.

- $100 million in one-time Prop 98 GF to address food and housing insecurity among CCC students.

- $30 million to support student technological access to higher education, as well as increase student mental health resources.

- $20 million for a systemwide effort to provide culturally competent online professional development for CCC faculty.

Expanding Work-Based Learning Opportunities: The Budget includes $35 million Prop 98 GF to support the following investments in work-based learning:

- $15 million ongoing to augment the CA Apprenticeship Initiative.

- $20 million to expand work based learning models and programs at community colleges.

Other Budget Adjustments

- Zero-Textbook-Cost Degrees: An increase of $15 million one-time prop 98 GF to develop and implement zero-textbook-cost degrees using open educational resources.

Financial Stability + Labor & Workforce Development

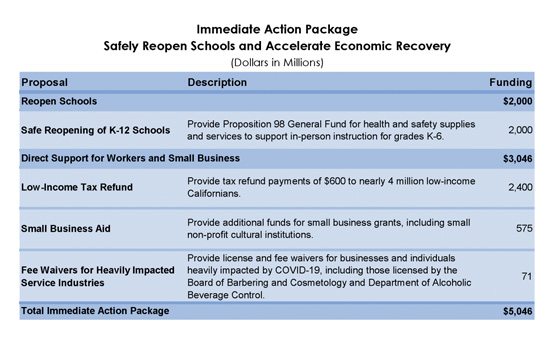

CalEITC: The Budget proposes a $2.4 billion Mid-Year Action. This investment would provide low-income filers making less than $30,000 annually to receive an additional $600 payment. (estimated 4 million Californians to receive).

Employment Development Department: Budget proposal includes $46,348,574

- Unemployment Insurance Program: $34,620,935

- Disability Insurance Program: $10,497,695

- Workforce Innovation and Opportunity Act: $402,021

California Jobs Initiative: Governor proposes $777.5 Million to fund this initiative. Details of the initiative are as follows:

- California Competes Program: $430 Million. A $90 Million dollar increase to this tax credit program from last year to further incentivize businesses to create and retain jobs in California. This proposal additionally includes a mid-year action of $250 million in one-time General Fund to create a competitive grant program for businesses meeting specific investment or job creation criteria, $50 million of which is reserved specifically for businesses located in “high-need, high-opportunity” areas.

California Rebuilding Fund: Proposed $12.5 Million. This fund is a public-private partnership meant to provide loans to the small businesses.

Small Business COVID-19 Relief Grant Program: Proposed $575 million. This program would provide grants of up to $25,000 for small businesses and nonprofit organizations that have been impacted by COVID-19, with priority given to regions and industries particularly hard-hit as well as disadvantaged communities and “underserved small business groups.” The Governor is additionally proposing these investments be included in the mid-year budget action.

Financial Health & Human Services

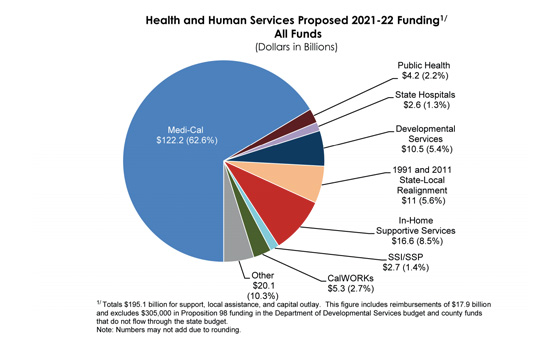

The Budget includes $195 billion ($64 billion GF and $131 billion other funds) for all health and human services programs. The Budget assumes that the COVID-19 Pandemic response continues at some level until December 2021.

- Office of Health Care Affordability: Budget includes $11.2 million in 2021-22, $24.5 million in 2022-23, and $27.3 million in 2023-24 and ongoing from the Health Data and Planning Fund to establish the Office of Health Care Affordability.

- Community Navigators: $5.3 million for the Department of Developmental Services to contract with family resource centers to implement a navigator model statewide.

- Expanded Facilities to Support Housing: $250 million one-time GF to acquire and rehabilitate Adult Residential Facilities (ARF) and Residential Care Facilities for the Elderly (RCFE) with a specific focus on preserving and expanding housing for low-income seniors who are homeless or at risk of homelessness.

Behavioral Health: $750 million one-time General Fund, available over three years, for competitive grants to support acquisition and rehabilitation of properties for behavioral health treatment facilities, including community-based residential facilities.

- $400 million one-time in a mix of state and federal funding, available over multiple years, to implement a program intended to increase the number of students receiving behavioral health services from K-12 schools. The Department of Health Care Services would implement this program through Medi-Cal managed care plans, in partnership with county behavioral health departments and schools.

- $27.1 million General Fund for a one-year delayed suspension of Medi-Cal post-partum extended eligibility, which extends the duration of Medi-Cal eligibility for postpartum care for an individual who is diagnosed with a maternal mental health condition.

- $25 million one-time from the Mental Health Services Fund to expand the Mental Health Student Services Act Partnership Grant Program, which funds partnerships between county behavioral health departments and schools.

- $25 million ongoing Proposition 98 General Fund to fund county behavioral health partnerships that support student mental health services.

Proposed Budget fails to expand Medi-Cal coverage to undocumented senions, delays potenial suspension of state funing for Medi-Cal Provider Payments.

Department of Health Care Services: Medi-Cal budget is $118 billion in 2020-21 and $122 billion in 2021-22. Budget assumes that caseload will increase by 10% from 2019-20 to 2020-21 and increase 11.7% from 2020-21 to 2021-22.

CalAIM: The administration assumes that implementation of these various reforms would begin on January 1, 2022, and that $1.1 billion ($531.9 million General Fund) would be available during the initial fiscal year (2021-22) to:

- Provide enhanced care management – a collaborative approach to providing intensive and comprehensive services to individuals;

- Support “in lieu of” services, which include housing transition services, recuperative care, and respite;

- Fund infrastructure needed to expand “whole person care” programs statewide;

- Build upon existing dental initiatives, such as the Dental Transformation Initiative, which aims to expand preventive dental services for children.

Social Services: The Budget includes $36.2 billion ($14.4 billion GF) for Department of Social Services Programs.

- $250 M: One time GF for Department of Social Services for Adult Residential Facilities (ARF) and Residential Care Facilities for the Elderly (RCFE)

- $30 M: To fund existing Emergency Food Assistance Program providers, food banks, tribes, and tribal organizations

- $22.3 M: Ongoing for Supplemental Nutrition Benefit and Transitional Nutrition Benefit Programs Adjustment

- $11.4 M: One time for California Food Assistance Program (CFAP)

- $7.4 B: For CalWORKs program, whose average monthly caseload is estimated to be 482,436 families

- $16.5 B: For IHSS (In Home Supportive Services)

- $1.2 B: Support Projected Minimum Wage Increases to $14 per hour in 2021, $15 per hour in 2022

- SSI/SSP: $2.69 B General Fund for 2021-22

- Child Welfare: $61.1 M for COVID-19 Related Supports for Child Welfare Services

- Immigration Services: $75 million

Homelessness:

- Project Homekey: Building on the success of Homekey – the state’s innovative solution to help local jurisdictions acquire hotels, motels and other facilities to provide permanent housing for people experiencing homelessness or at risk of homelessness – the Governor is proposing $750 million to extend Homekey, including $250 million in the current year and $500 million Fiscal Year 2021-22. This will be administered by the Department of Housing and Community Development (HCD).

Housing:

- Mid-Year Adjustments on Rent Relief: In late December the federal government enacted COVID-19 Relief that included rent relief funds with an approximate $2.6 billion for California, to be split between the state and local governments with populations over 200,000. This rental assistance will be used to support low-income tenants under 80% of Area Medium Income (AMI). These resources can be used for past due rent and utilities, as well as future rental payments.

- Eviction Protections: The Administration is proposing an immediate extension of the eviction protections established in AB 3088

- Low-Income Housing Tax Credits: A third round of $500 million in tax credits to reduce funding gaps in affordable housing units. These tax credits will be administered by the California Debt Limit Allocation Committee and the Tax Credit Allocation Committee, and BCSH and our departments will work closely with them.

- Infill Infrastructure Grant Program: $500 million in General Fund dollars are included to create jobs and increase long-term housing development to further a more equitable housing supply in a post-COVID-19 housing market. This includes $250 million in the current Fiscal Year and $250 million in Fiscal Year 2021-22.

- Housing Accountability: $4.3 million in General Fund dollars are included to create a Housing Accountability Unit within the Department of Housing and Community Development to provide technical assistance to help local governments navigate and comply with state housing laws and make progress toward their Regional Housing Needs Allocation.

- Department of Fair Employment and Housing: To further fair housing, civil rights and our equity goals, Governor Newsom’s proposed budget includes $2 million to conduct extensive education and outreach to address housing discrimination.

Emergency Preparedness & Response The Budget includes $1 billion for wildfire resiliency and emergency response.

- $143.3 million for more fire crews

- $48 million: Black Hawks, C-130 Large Air Tankers

- $39 million: LiDAR remote sensing, research

- $17.3 million: Earthquake Early Warning System

$4.4 B: COVID-19 Emergency Response

- $2B: Testing

- $473 M: Contact Tracing

- $372 M: Vaccines

Economic Outlook for California

The governor’s economic outlook expects Californians to gain back jobs slowly, with the total number of jobs in the state not returning to pre-pandemic levels until 2025. The forecast also expects that increased automation and the shift to online retail will permanently eliminate some jobs in the low-paying leisure and hospitality, retail, and “other services” industries. This means that some unemployed workers will not have jobs to come back to once the pandemic is over and will have to find employment elsewhere. For this reason, the administration projects that employment in these industries will remain below their pre-pandemic levels beyond 2025. The outlook also points out that the recent approval of Proposition 22, which allowed gig economy companies to classify their workers as independent contractors, will lead to a decline in the quality of many jobs in the state.

It is important to consider that the governor’s outlook may be overly pessimistic because it did not take into account the impact of the federal economic relief bill that was enacted in December. This means, for example, that it incorrectly assumed that millions of Californians would lose access to unemployment benefits beginning late last year. That said, the administration points to a number of factors that could cause the economic outlook to worsen, including more widespread job losses than anticipated, more business closures than expected, or a “failure to address structural inequality.”

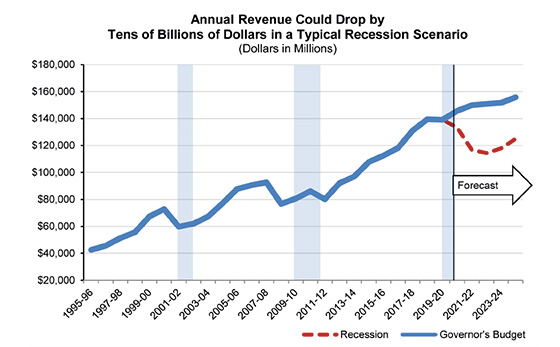

The 2020-21 budget agreement enacted in June included actions to close a $54 billion budget gap that was projected as a result of expected revenue losses and spending increases due to the COVID-19 pandemic and recession. However, the governor’s 2021-22 budget proposal reflects an improved revenue outlook over the 2020 Budget Act assumptions and a one-time $15 billion “windfall” that can be allocated during the current budget cycle.

This improved outlook and windfall are due to two main factors. First, while many Californians are facing severe struggles in the COVID-19 economy, those with high incomes have continued to fare well, and this group is responsible for a large share of the state’s General Fund revenue due to the progressive personal income tax (PIT) system. Second, the recession has been less severe than expected, largely due to federal assistance to workers, families, and businesses. As a result, the administration projects General Fund revenue will be $71 billion higher than anticipated in the 2020 Budget Act over the three-year budget period, covering fiscal years 2019-20 through 2021-22. This includes higher estimates over the budget period for the three primary General Fund revenue sources, including $58 billion in personal income tax revenue, $9 billion in sales tax revenue, and $1.3 billion in corporation tax revenue.

The budget proposal warns that the revenue situation could deteriorate in the case of a sharp decline in the stock market, a rise in bankruptcy, or more widespread unemployment affecting higher-income Californians. The proposal also notes that the revenue estimates were completed prior to the enactment of the recent federal COVID-19 relief package, which should reduce the likelihood of a more severe recession scenario in the short-term.

Although the outlook for the current budget is improved, the administration conservatively projects that the three main General Fund revenue sources will grow by only 1.9% annually between 2019-20 and 2024-25, significantly slower than the 6.4% average growth rate since 2009-10. Additionally, expenditures are expected to grow faster than revenues over this time, resulting in a structural deficit of $7.6 billion for 2022-23, growing to $11 billion by 2024-25 without actions to increase revenues, reduce spending, or a combination of the two.