Everyone deserves the opportunity to earn a living that can sustain a family and build security for future generations. That’s why United Ways of California and local United Ways across the state advocate for policies and provide education and programming that help hard-working Californians make ends meet and empower them to create a stronger financial future for every generation. Key components of this work include providing free tax help, advocating for tax credits that support Californians with low-to-moderate incomes, and connecting eligible community members with these critical credits.

To further inform this work, United Ways of California wanted to better understand how community members’ financial situations affect their attitudes, well-being, and behaviors, including tax filing. United Ways of California worked in partnership with Mockingbird Analytics and Dr. Annie Harper, a researcher from Yale University, to survey nearly 3,000 community members who have used United Ways of California programs and services, conduct follow-up focus groups, and release an accompanying academic study on the subject. Goals included reducing stigma around people with low incomes and supporting informed decision-making around policies and programs designed to help more working families achieve financial stability.

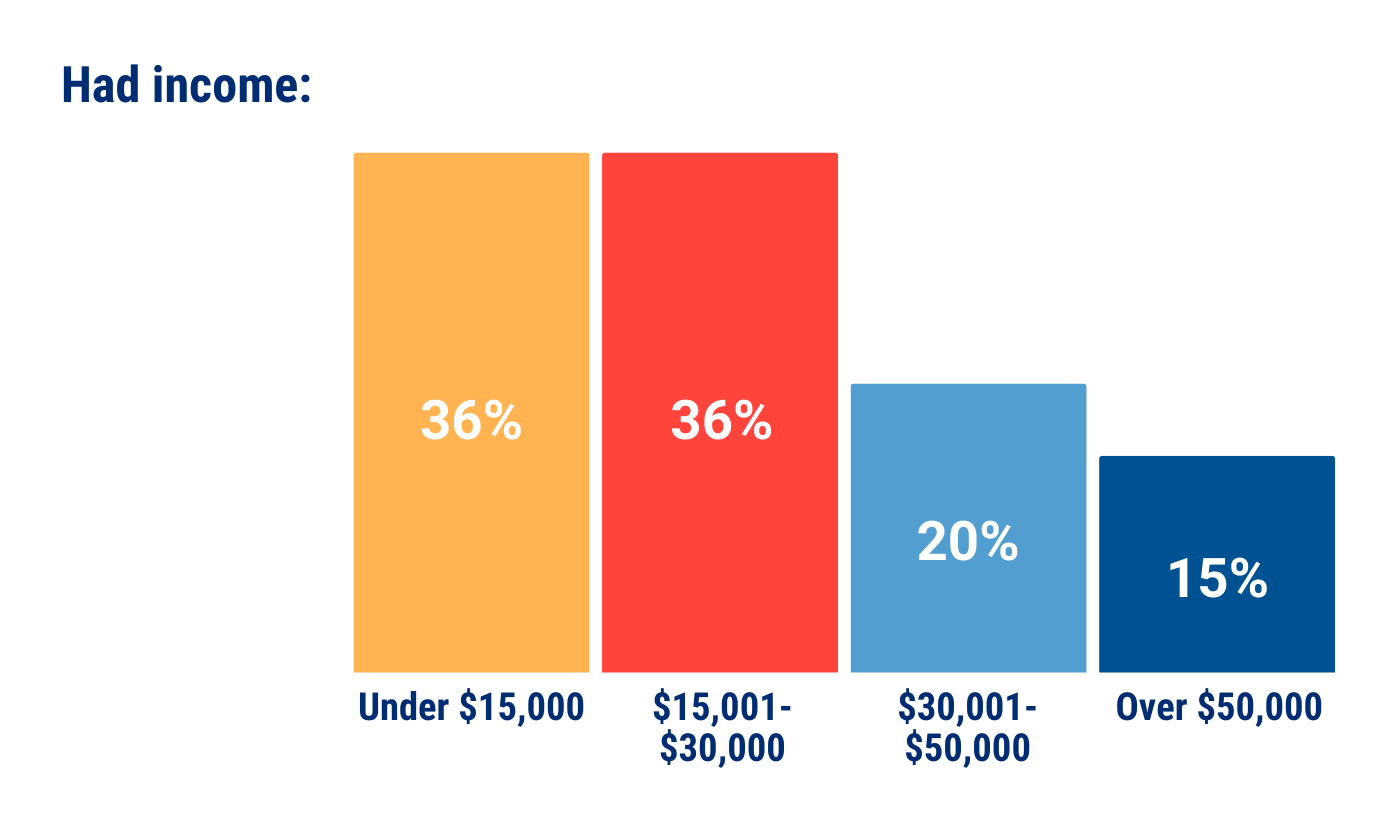

Most respondents were women who have children, identify as Hispanic or Latine, had a paying job, and earned less than $30,000 annually. This means that most are eligible for free tax prep assistance and tax credits like the California Earned Income Tax Credit (CalEITC), federal Earned Income Tax Credit (EITC), federal Child Tax Credit (CTC), and state Young Child Tax Credit (YCTC), though not all respondents filed tax returns the previous year.

Study data show that these community members are struggling financially and are also resilient. They are doing what they need to do, despite having limited income and often not having access to financial services that work well for them.

Why Taxes and Financial Stress?

The federal EITC is the largest, most successful national anti-poverty program in the United States. It is the most effective pathway to lifting households out of poverty. When combined with other refundable tax credits—like the federal Child Tax Credit as well as state refundable earned income and child tax credits, where available—its anti-poverty power is amplified. As a key way to ensure access to the cash that comes from refundable credits like these, the Volunteer Income Tax Assistance (VITA) program offers free tax preparation services to income-eligible people. VITA saves Californians money on tax preparers and helps them access all the credits they are eligible to receive; studies have shown that many CalEITC-eligible filers who used paid preparers did not claim the credit, while VITA volunteers are trained to look for these credits to maximize community member refunds. Research has shown the importance of VITA as a successful anti-poverty program in the United States, with substantial positive health impacts from access to tax credits. For decades, United Ways across the country, including United Ways of California and our partners, have implemented VITA and tax credit outreach programs. California United Ways currently fund, lead, or support about two-thirds of the state’s VITA sites and have been active advocates for expanding tax credits, playing an instrumental role in the creation and expansion of the CalEITC.

“My goal is to not owe taxes, because we’ve already spent what we’ve earned on necessary expenses. Even with two incomes, living in California is so expensive. I always look at ways to save. VITA saves me hundreds of dollars I would have had to pay someone to do my taxes. They also help me ensure I get all my available tax credits and maximize my tax refund every year. That money can be used on so many important things to help my family.”

— Ivonne Sonato-Vega, a mom of 5 in Santa Rosa and United Way of the Wine Country VITA client

Study Highlights

■ 82% of respondents filed taxes the previous year.

- For the remaining 18% of respondents, reasons for not filing included not knowing where to start, not being required to file, and not expecting a refund.

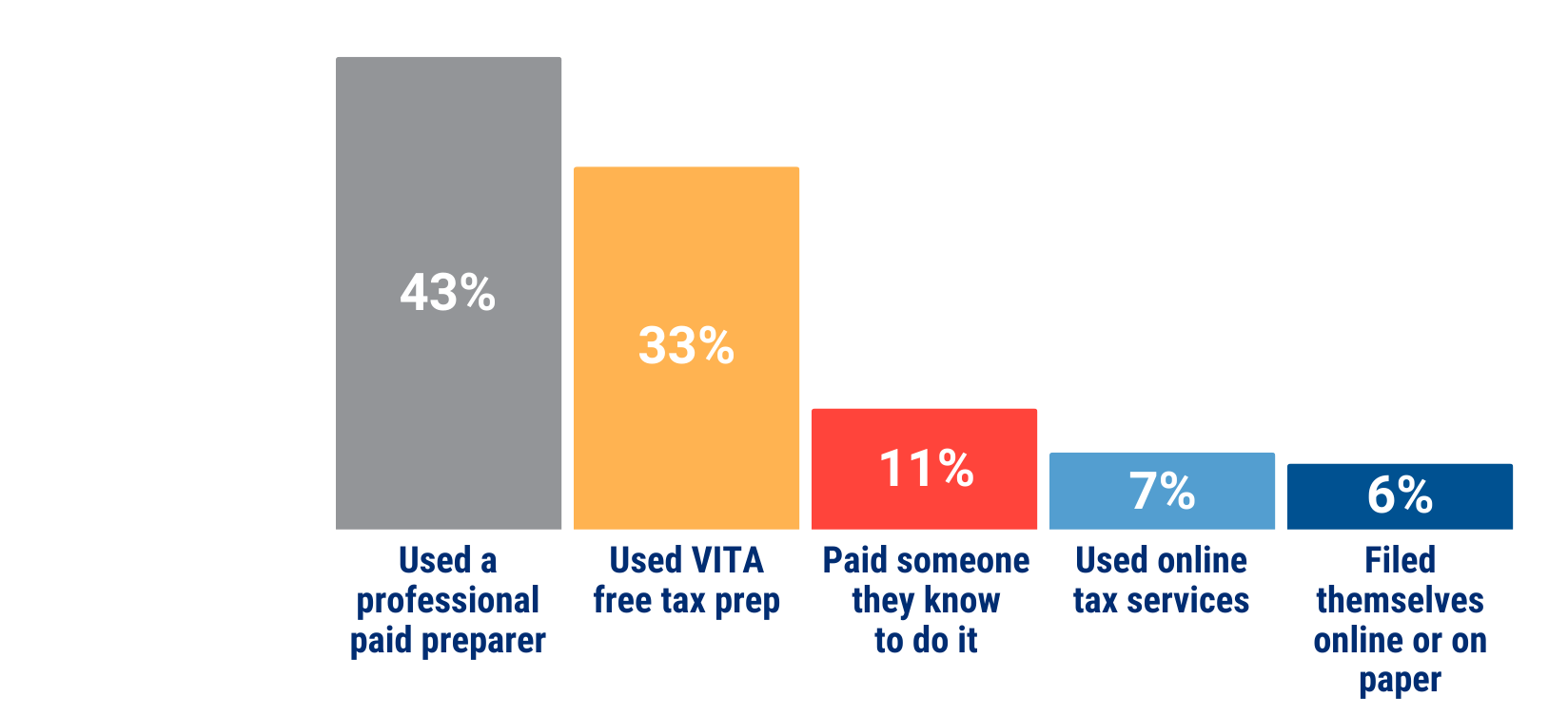

■ Of those who filed their taxes:

■ Most (68%) respondents who filed their taxes but didn’t use VITA simply didn’t know about it, indicating there is a need for more outreach about the service.

■ When asked what was most important when filing taxes, the most popular responses related to ensuring community members kept as much cash in their pockets as possible:

- Getting the full Earned Income Tax Credits and child tax credits (27%)

- Receiving the largest refund possible (22%)

- Paying as little as possible (22%)

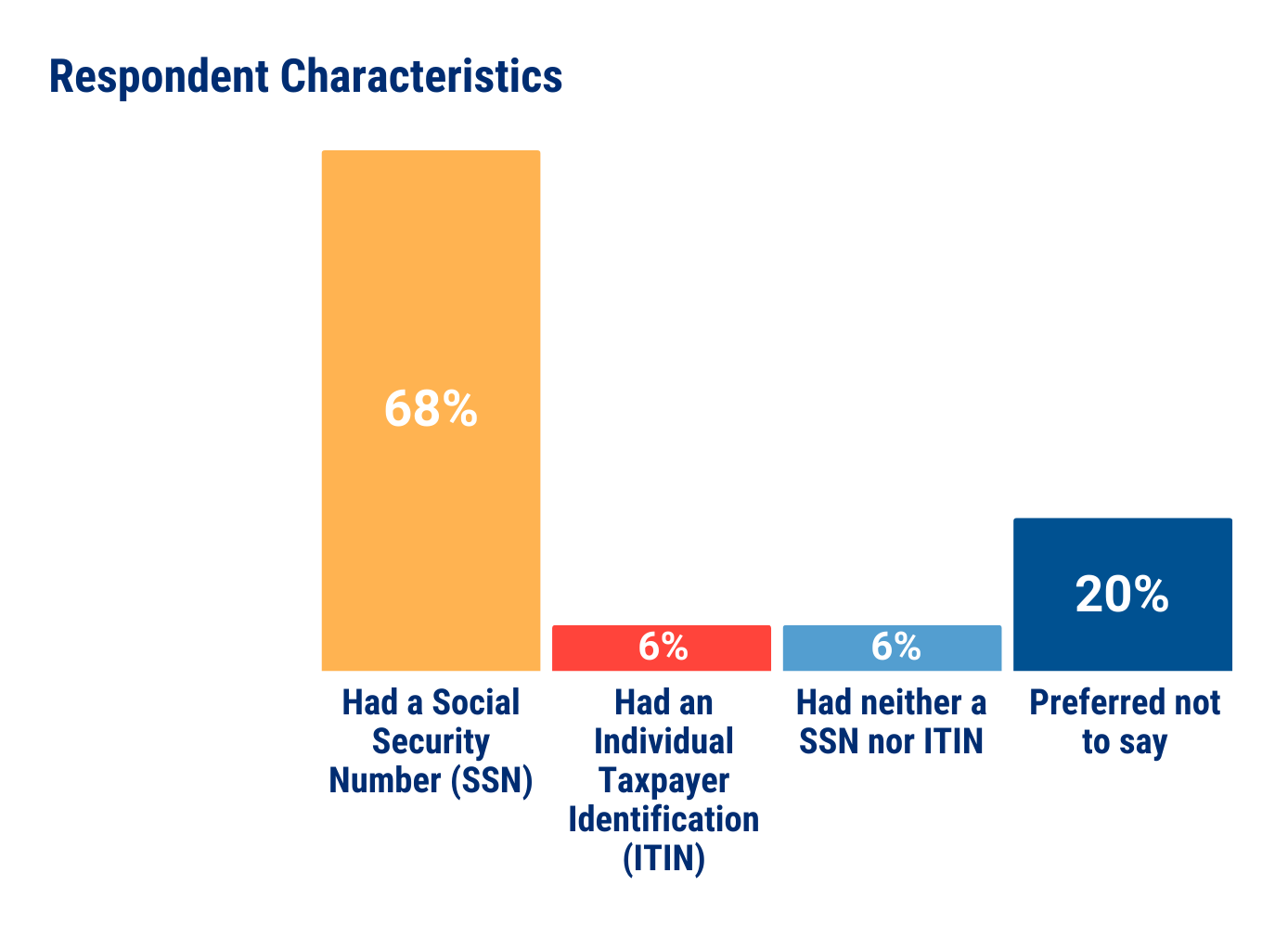

■ Respondents who had a Social Security Number (SSN) were much more likely to file tax returns and use VITA than those who do not.

■ 88% of respondents reported they found it difficult to cover monthly expenses. This is significantly higher than the national average of 29%, or even the findings of a nationally representative study where 67% of those with incomes under $25,000 expected to pay their bills in full.

■ Respondents who had accounts with a bank or credit union (“banked”) reported higher levels of stress than those without bank accounts.

■ Respondents who reported always paying their bills on time had significantly lower financial well-being scores, meaning they had higher stress and fewer indicators of financial stability, than those who did not pay on time.

■ Respondents who had accounts with a bank or credit union (“banked”) reported higher levels of stress than those without bank accounts.

■ Respondents who reported always paying their bills on time had significantly lower financial well-being scores, meaning they had higher stress and fewer indicators of financial stability, than those who did not pay on time.

■ Focus group data suggested that those who are more flexible about when they pay their bills may actually be better at managing the ups and downs of their finances than those who pay bills as they are due, indicating a financial savviness and resourcefulness in the face of tight or insufficient cash flow.

■ Respondents who filed tax returns had slightly higher financial well-being scores than those who did not.

■ Those who reported not filing taxes in the last 12 months had significantly higher odds (32%) of being in a higher category of financial stress compared to respondents who did file their taxes.

“Living paycheck to paycheck with no savings, I’m always hoping and praying that I don’t have a financial emergency.”

— Survey Respondent

“Wish I could make more money to pay my bills so I wouldn’t feel so small.”

— Survey Respondent

■ 33% of respondents were unbanked, compared to a national average of 4.5%. Of those who were unbanked and shared a reason, 23% said they didn’t have enough money to avoid minimum balance fees.

■ 15% used check cashing services (the national rate is 3%, or 22% among those who are unbanked) and 6% used money transfer services (compared to 7% nationally).

■ 13% of respondents reported seeking a tax refund anticipation loan—more than 5 times the national average but comparable to studies of people with similar income and other demographics.

■ 13% of those texted with this survey invitation (past users of United Ways of California programs and services) began the survey—about 2.5 times higher than the typical SMS text survey response rate—and 54% of those who started the survey completed it, taking about 15 minutes to answer 30 questions.

■ From these high survey response and completion rates, United Ways of California concludes that organizations can serve as trusted messengers to gather high-quality community member feedback.

■ Survey respondent demographics illustrated that United Ways of California and our tax partners are reaching—and are trusted by—several vulnerable groups, including those with low incomes, Latine Californians, and women with young children.

■ While United Ways of California and our partners support tens of thousands of Californians each year through free tax prep, there are many more eligible Californians who simply don’t know about VITA. This supports the need for more funding for free tax prep services as well as education and outreach to help community members understand their free filing options and tax credit eligibility.

Reducing Stress and Increasing Financial Well-Being

Refundable tax credits—such as the federal EITC and Child Tax Credit and California’s state counterparts, the CalEITC and the YCTC—are the most powerful poverty-fighting tools available.

One example: Cindy is a single mom of three living in Northern California. Despite working full time as a medical receptionist, she found herself and her daughters living in a shelter. During the pandemic, Cindy was connected to a United Way free tax prep site and received a refund of over $14,000—mostly through state and federal refundable tax credits. She was able to pay off medical debt, get her family into stable housing, and connect to a support network. Cindy was able to change the trajectory of her family in one tax season.

California has taken dramatic strides to increase access to these credits, including taking a more equitable approach to the credits by making the state credits available to people filing with an ITIN, while their federal counterparts are only available to those with SSNs. Unfortunately, though, millions of Californians still fail to claim billions of dollars in federal and state credits every year. As our survey data indicate, awareness of these credits and access to assistance from trusted community organizations can ensure more California households take advantage of these critical supports. The survey data also illuminate additional opportunities for financial education and support systems that could increase financial well-being.

We know from our Real Cost Measure study that these community members are working hard (97% of California households who are struggling to make ends meet have at least one working adult). It’s up to community organizations and state and federal leaders to make changes that will reduce barriers to financial well-being.

Below are some recommendations to increase financial well-being for vulnerable Californians. Some require policy changes, while others are best practices that California United Ways are already implementing.

Increase Awareness of and Access to Refundable Tax Credits

- Increase funding for outreach and awareness of the CalEITC and other refundable credits to ensure all eligible households can claim these credits, particularly those who are more difficult to reach but have high financial needs.

- Continue to expand targeted outreach about tax credits to Spanish speakers, people without Social Security Numbers, people who are unbanked, and people who are highly stressed about their finances. This often requires the use of trusted messengers, such as other community-based organizations with strong relationships, community institutions like churches and schools, and other community members with shared lived experience.

- Advocate for federal and state tax authorities to pre-fill tax returns for low-income households that only have wage (W-2) income as well as to automatically send refundable EITC and CTC tax credits to eligible households without requiring they file a tax return first.

- Encourage or require state and county agencies managing public benefits to inform families and individuals about the availability of refundable tax credits and free tax filing assistance programs.

Continue and Expand Free Tax Filing and Assistance Options, Including VITA

- Increase state and federal funding for VITA free tax filing services in order to increase capacity to recruit more volunteers, host more in-person sites, and expand free online assistance.

- Continue increasing the number of VITA volunteers and staff who have shared lived experiences with community members accessing services and can provide culturally competent services.

- Continue to partner with other programs and services as an entry point to VITA, creating holistic wrap-around services for community members.

- Increase the extent to which VITA is visible year-round to improve community member awareness and program familiarity and trust (professional tax preparers and banks with physical locations were indicated as the most trustworthy intuitions).

- Support continued implementation of and expanded eligibility for the IRS Direct File tool, ensuring state tax filing is fully integrated, to provide free online self-filing options for all.

Protect and Empower Community Members with Information and Expanded Options

- Make banking more accessible to low-income households, especially to community members without an SSN or Individual Taxpayer Identification Number (ITIN), perhaps through creation of public banking options like those being considered by the state of California and others.

- Ensure that all VITA clients know about the benefits of bank accounts with accredited institutions, including Bank On accounts, which do not have overdraft fees.

- Use VITA as an opportunity for holistic financial counseling services, delivered by trusted providers using culturally competent methods, including understanding of why people with low incomes make certain financial management decisions, as detailed in our study.

- Streamline public benefits enrollment to allow easier access to these programs, helping community members save on monthly expenses and increase their financial well-being.

- Pass legislation to prevent predatory pricing by individuals and firms providing for-profit paid tax preparers and ITIN application services, perhaps by requiring upfront disclosure of full estimated costs, including the finance charges on refund advances.

Opportunities for Further Research

While focus groups helped us gain insight into potential explanations for surprising survey data, additional quantitative research with larger sample sizes than the focus groups may be helpful in developing a stronger understanding of certain factors illuminated by our survey data. Such further research opportunities could include deepening understanding of:

- Why people who reported paying bills on time also reported increased financial stress, as well as why those who reported not paying bills on time were more likely to report filing their taxes and using VITA. (Expand sample size to explore accuracy of focus group data suggesting that those who are more flexible about when they pay their bills may actually be better at managing the ups and downs of their finances than those who pay bills as they are due.)

- Reasons for the relationship between higher financial stress and having a bank account. (Again, testing the hypothesis based on focus group feedback that this is due to concerns about overdraft fees as well as increased visibility of financial situation.)

- How to increase trust and uptake of VITA among community members who know about the service but do not use it.

Methodology

Text messages were sent to 40,000 community members who had previously opted in to receive text messages from United Ways of California through various programs, including:

- Free tax prep assistance

- Public benefit screening

- Food and Farmworker Relief program

- Rent assistance during the COVID-19 pandemic

- Rideshare transportation to and from medical appointments, including COVID-19 vaccinations

Gift card incentives were tested in batches. The overall click-through rate for text messages was 13%, with survey completion rates ranging from 5-8%, varying based on the incentive. Larger incentives—or possibility of a larger incentive through a raffle—resulted in higher completion rates.

| Group | Incentive | Completion Rate |

|---|---|---|

| 1 | $30 gift card for all who completed the survey | 8% |

| 2 | $15 gift card for all who completed the survey | 5% |

| 3 | Those who completed the survey were entered into a raffle for a $150 gift card, with two winners | 7% |

To dig deeper into trends revealed by the survey data, Dr. Annie Harper conducted two focus group sessions with four community members, who each received $200 cash payments for their time.

Aligned with organizational equity and inclusion values, United Ways of California believes in compensating community members for their voluntary time whenever possible. Participants are giving up time that could be spent working, with family, taking care of themselves, and more. Their lived experience is also expertise they are bringing to the organization and should be treated as such. These community members were instructed to be honest and not be influenced by this compensation in their responses.

Respondent Characteristics

- 76% of respondents identified as Hispanic/Latine

- 69% of respondents identified as female

- 60% had children aged 0-5, 50% had children ages 6-17

- 74% had income from at least one job that pays a wage or salary

- 10% reported income from Supplemental Security Income or Social Security Disability Insurance

United Ways of California and our partners are committed to advocating for and supporting Californians with low-to-moderate incomes by providing free tax help, helping them understand tax credits and other benefit programs they may be eligible for, and advocating for policies that put more cash in their pockets, like tax credit expansions. The survey responses show that we are reaching the right people and that we must continue this critical work—as well as other financial empowerment programming—to support even more California families and to support existing families in deeper ways.

Learn more:

- United Ways of California’s Financial Empowerment Work

- MyFreeTaxes.org

- MyMoneyPath.org, an online financial literacy and empowerment tool