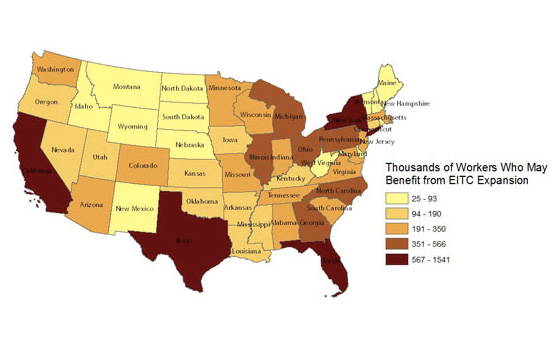

California Would Benefit Most Under EITC Expansion

Earlier this month, the Executive Office of the President and the U.S. Treasury Department released a proposal to expand the Earned Income Tax Credit (EITC) by $60 billion. This is significant as EITC is the largest public anti-poverty program for workers not receiving Social Security benefits.

If the proposal goes through, over 7.7 million people will receive a larger EITC benefit, and 5.8 million would become newly eligible. The Washington Post reports “Workers would get 15.3 cents back on every dollar they earn up to $6,570, for a maximum of $1,005. Then the tax credit is frozen until the worker earns $11,500.” Once a worker reaches $18,070 in annual income, the tax credit will automatically phase out.

As the map below illustrates, the President’s proposal estimates that 1.5 million Californians will benefit the most from EITC expansion, easily the highest in the nation.

Data Source: US Department of Treasury, Office of Tax Analysis

While the proposal is welcome news for low-income populations nationally, it’s important to note that billions of dollars in earned income tax credits continue to go unclaimed every year. In 2009 alone, the New America Foundation found that $1.2 billion in earned income tax credits went unclaimed in California, generating up to a $1.4 billion loss in sales and possibly, 8,200 uncreated job opportunities. If materialized, fully claiming EITC could have helped low-income populations (and the State in general) offset some of the economic impacts felt during the height of the Great Recession.

One possible solution is for eligible persons to qualify for the Earned Income Tax Credit automatically when they file their taxes, without having to complete additional paperwork. While this would take a tax reform bill to materialize, it could help the state economy and perhaps more importantly, the well-being of California’s low-income families. In light of this, what other ideas do you have to help eligible Californians claim the Earned Income Tax Credit? Please share some of your thoughts in our comment section below.

To learn more about the impact of the EITC, including some promising results it has on encouraging student success, read this excellent analysis by the nonpartisan Center on Budget and Policy Priorities.